pKYC

Automatic KYC refresh and continuous risk assesment

How KYC360 helps automate perpetual KYC

Traditional KYC processes often fail to capture changes in client risk profiles in real-time, leading to regulatory breaches and significant enforcement actions from regulatory authorities. As compliance expectations tighten and penalties grow harsher, firms must adopt a more dynamic approach to managing customer risk.

The KYC360 Perpetual Know Your Customer (pKYC) module shifts compliance processes from static, periodic reviews to an efficient event-driven approach, ensuring customer information remains accurate and up to date.

Capable of automating KYC dynamically for large volumes of customers allowing you to benefit from operational efficiencies, improved CX and a higher level of compliance assurance.

Benefits

Learn more about pKYC

The complex regulatory landscape and threat of harsher enforcement actions are forcing firms to review their compliance processes. It is crucial for firms to dynamically maintain accurate customer information as client risk profiles can change quickly.

An automated approach can increase operational efficiencies and scalability. It can also free up staff from burdensome repetitive work and allow them to focus on core business activities. However, there are a variety of challenges for firms considering a transition to pKYC.

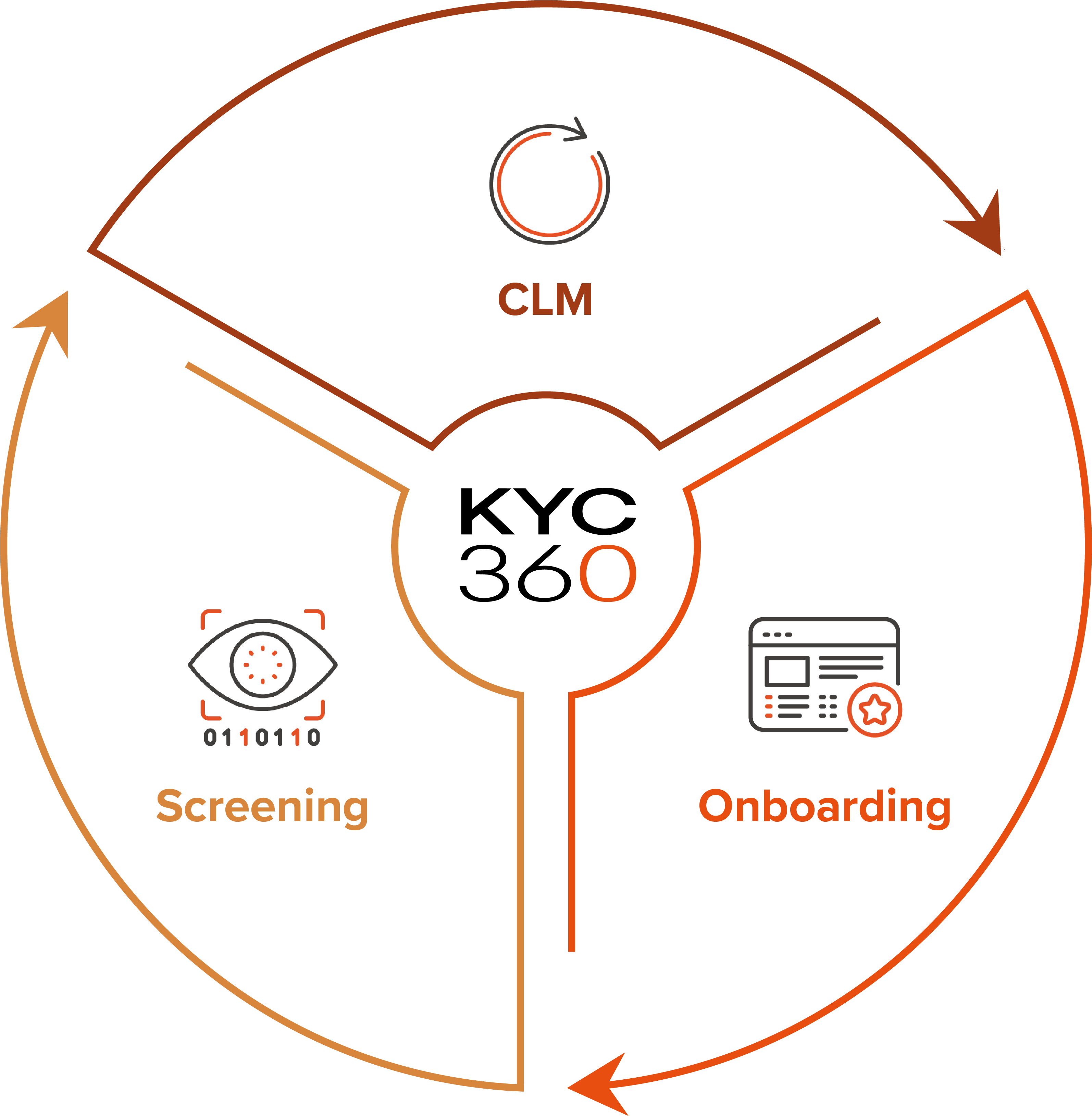

Full cycle risk management

pKYC is designed as a lightweight alternative to full lifecycle Customer Lifecycle Management (CLM) and is available as an additional module within the KYC360 Onboarding solution. For organisations requiring full lifecycle risk management, our CLM solution provides a comprehensive, end-to-end approach.

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.

Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, Screening, Perpetual KYC (pKYC) and CLM tasks, with market-leading data sources pre-integrated under a single license agreement. Live risk scoring and automated data collection enables a shift from periodic to event-driven review, while providing a single actionable picture of real-time risk with all documents and data in one place.