How KYC360 helps streamline risk management

For many financial institutions, risk management after initial onboarding remains a costly, inefficient process. Customer data is scattered across fragmented systems, risk is often assessed infrequently in static formats such as Excel, and valuable time is wasted rekeying information and chasing documents. Reviews become reactive and resource-heavy, frustrating customers, draining staff morale, and leaving blind spots between periodic checks.

The KYC360 Customer Lifecycle Management (CLM) solution changes this by streamlining risk management across the full lifecycle. By creating a single, always-current source of truth, CLM consolidates documents, data, and risk decisions in one place.

Benefit from continuous monitoring and a live, dynamic view of each customer’s risk profile. Respond instantly to KYC trigger events such as expired documents, sanctions, or adverse media, and move from static periodic reviews to proactive, event-driven oversight.

With automated external data collection and live risk recalculation, CLM reduces wasted time and streamlines the data refresh process while providing a complete audit trail.

Benefits & Features

Respond to changes in real-time, enhancing customer trust and retention. Nominate fields and instantly generate an external data collection link to request missing or updated data from clients.

Centralised data with dynamic live risk profiles accelerates critical decisions.

Event-driven reviews replace manual workflows and repetitive rekeying. Staff can auto-refresh or update data before a scheduled review where feasible.

Analyse trends and model changes in risk to make informed, forward-thinking strategic decisions.

A streamlined KYC refresh process reduces bottlenecks to growth and improves staff morale by freeing them up for higher-value tasks.

A single source of truth creates consistent outcomes with a full audit trail.

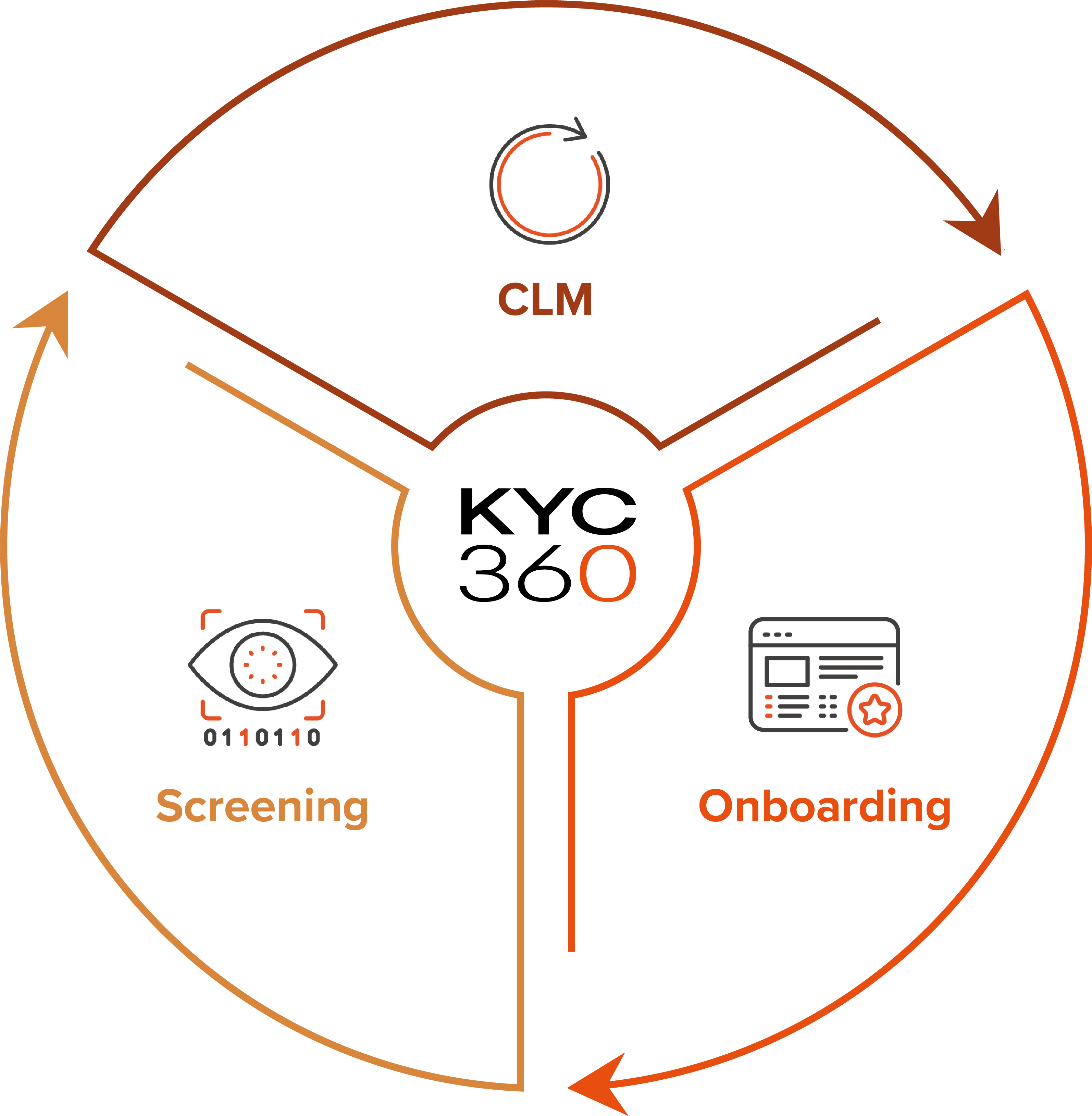

Consolidate customer information for a comprehensive real-time risk overview in one place, integrated with KYC360’s Onboarding and Screening solutions.

Run multiple models simultaneously (AML, ABC, suitability, operational risk), and tailor permissions for secure, jurisdiction-specific collaboration.

Generate business line and group-level reports on risk, KYC adequacy, and periodic review requirements.

Create highly tailored workflows to automate periodic reviews and trigger events and define steps, responsibilities and approvals, for both scheduled and unscheduled triggers.

Seamlessly manage KYC data across the entire lifecycle

With seamless integration with our Onboarding and Screening solutions, CLM enhances the flow of client information throughout the entire lifecycle and provides a single actionable view of risk with all documents and data in one place.

Advanced permissions and configurable risk models allow users to collaborate securely across jurisdictions while maintaining granular control over the sharing of sensitive information. The ability to analyse risk trends over time provides insights into evolving patterns and enables proactive decisions regarding risk appetite.

CLM transforms manual processes into a streamlined, intelligent and actionable system built for scalability, enhanced customer experience, and regulatory-ready transparency.

FAQs

Find answers to common KYC CLM questions.

Customer Lifecycle Management (CLM) in AML refers to the end-to-end management of customer relationships from onboarding through ongoing monitoring to offboarding. CLM KYC software centralises data, automates due diligence, and maintains a single customer view of risk, ensuring continuous compliance with AML throughout the client lifecycle.

Banks manage thousands of complex customer relationships across multiple jurisdictions. CLM solutions help them maintain consistent KYC and AML standards, reduce manual workload, and ensure regulatory compliance. Effective CLM reduces the risk of fines, streamlines reviews, and improves oversight of customer risk exposure across products and entities.

CLM software enhances customer retention by combining compliance efficiency with a smoother client experience. By reducing duplication of data requests, automating approvals, and speeding up onboarding or periodic reviews, it shortens turnaround times and builds trust.

Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, Screening, Perpetual KYC (pKYC) and CLM tasks, with market-leading data sources pre-integrated under a single license agreement. Live risk scoring and automated data collection enables a shift from periodic to event-driven review, while providing a single actionable picture of real-time risk with all documents and data in one place.

Architected for rapid deployment and ROI, the KYC360 no-code SaaS platform is flexible, fully configurable and modular so that you option and pay only for the functionality you need. Whether automating identity verification and background checks or monitoring risk in real-time, KYC360 adapts to your compliance needs, scaling as your business grows.