When high-net-worth individuals use an international financial centre to manage their wealth, they must undergo multiple onboardings with a professional services firm, a Trust or Corporate Services Provider and a bank to manage the trust. The process is tedious for all parties as it requires rekeying data manually and when KYC information needs to be updated, the process must be done again from scratch by all parties.

nKYC streamlines this entire process and allows KYC information to be sent electronically and securely between different parties, meaning customers can be onboarded in days rather than months. Any business that collaborates with introducers or intermediaries to gather KYC data can benefit.

Benefits & Features

Learn more about nKYC

Our established relationships with banks, professional services firms and TCSPs make us the ideal choice for a seamless onboarding process.

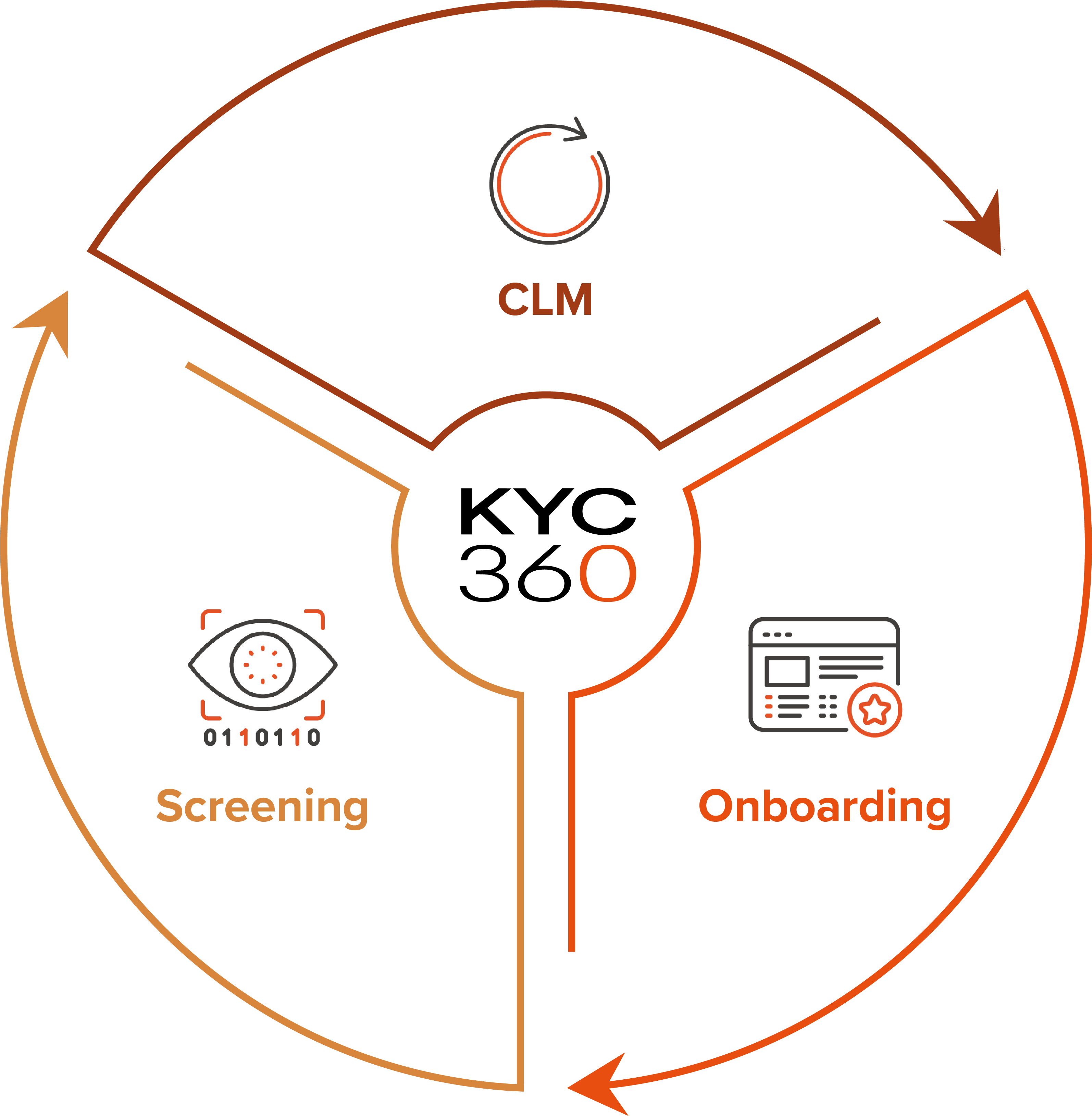

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.

Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, Screening, Perpetual KYC (pKYC) and CLM tasks, with market-leading data sources pre-integrated under a single license agreement. Live risk scoring and automated data collection enables a shift from periodic to event-driven review, while providing a single actionable picture of real-time risk with all documents and data in one place.