Remediating KYC data for existing customers is a near-constant task for many financial institutions either because they have identified out of date KYC information, or because they have been compelled to undertake remediation by an auditor or regulatory body.

What is KYC Remediation?

Remediation typically involves updating or sourcing KYC information held on client files and analysing whether the customer’s risk categorisation is accurate.

In the case of some historic customer relationships a KYC refresh can amount to almost a new onboarding of the customer, as nearly all the information held has to be renewed. In other cases it may only be a few details that need to be confirmed or updated.

The challenges of KYC Remediation

Whatever the position KYC remediation is an onerous and time-consuming task for the following reasons:

- Identifying the customer relationships requiring remediation is a major challenge for businesses that do not have automated in-life monitoring technology.

- In most businesses remediation is a manual exercise, done piecemeal by email and letters. It is a drag on staff productivity and morale.

- The customer’s motivation to supply fresh KYC information is lower than when they’re being onboarded requiring more chasing and correspondence. Some customers are very irritated by the process.

- Few businesses have dedicated remediation teams. If compelled by a regulator, a business may hire a consultancy firm to outsource the exercise. This is colossally expensive and usually of only limited effectiveness.

- If not outsourced, it becomes an extra task for staff who are already busy on other duties. It is rarely high priority and is therefore almost always behind schedule.

Utilising KYC360 for complex Remediation projects

KYC remediation projects can be complex, time-consuming, and resource-intensive, especially when dealing with large volumes of customers or stringent regulatory requirements. Ensuring that KYC data remains accurate and compliant requires a structured approach that minimises disruption to both customers and internal teams.

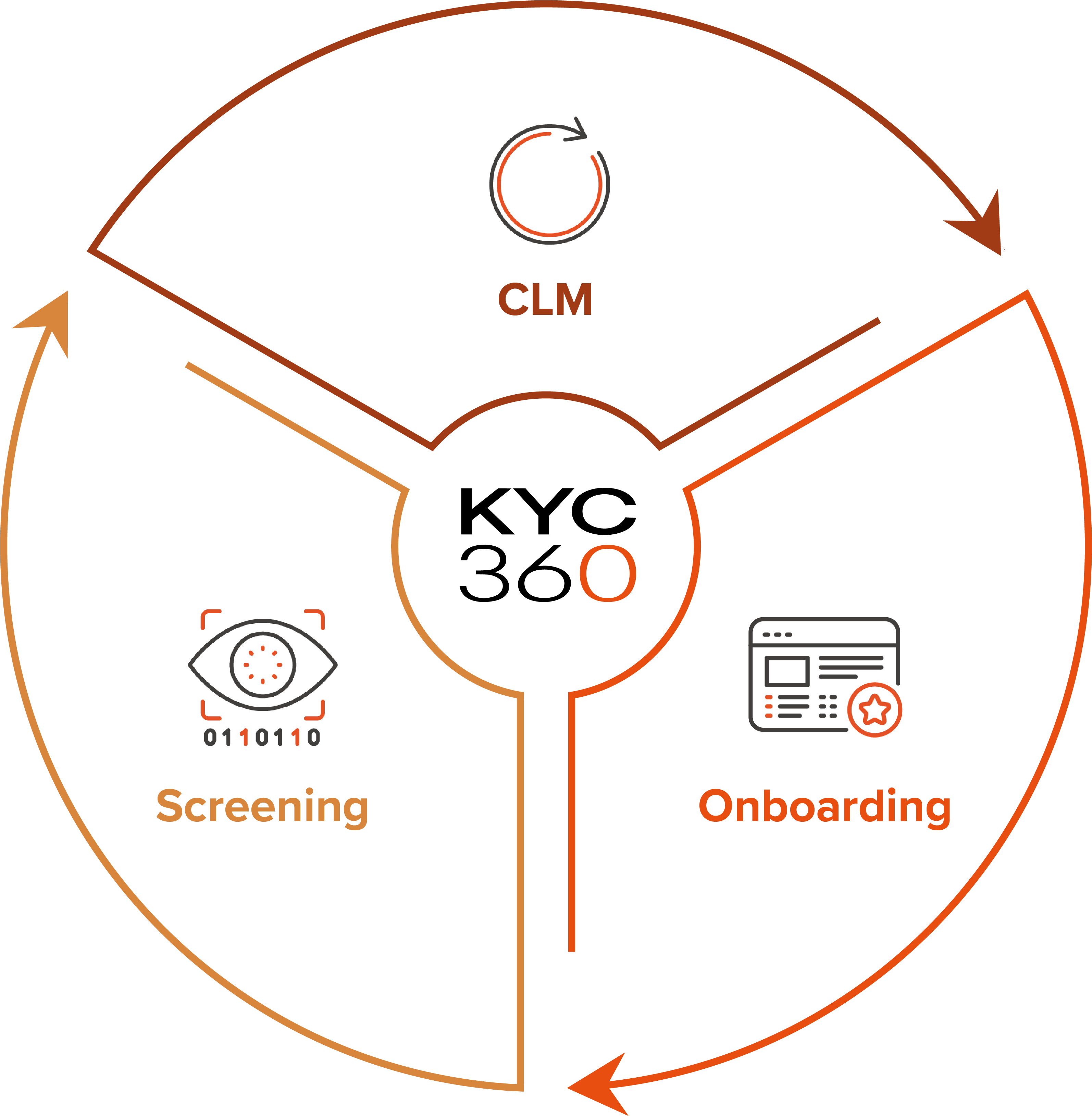

A key use case of the KYC360 Onboarding solution is enabling businesses to identify and update outdated KYC records efficiently. Organisations can take an automated approach to the KYC remediation process, reducing manual effort and improving data accuracy.

When used alongside the KYC360 platform’s Customer Lifecycle Management (CLM) solution, data remediation becomes a seamless part of ongoing risk management, ensuring that even complex customer relationships remain up to date while enhancing customer experience.

Access a world-class partner ecosystem

Learn more about Remediation

For further details on remediation and the best practices to follow read our "Definitive Guide to KYC Remediation" or watch the video below.

Report: The Future of KYC Remediation

Top Priorities and Challenges in 2025

To better understand how organisations are tackling Remediation hurdles, we surveyed 116 compliance professionals. Read the report to gain critical insights into how organisations are managing data remediation projects, highlighting their key priorities and the biggest roadblocks to success.

FAQs

Find answers to common KYC Remediation questions.

KYC Remediation is the process of reviewing and correcting customer records to ensure they meet current regulatory and internal compliance standards. It typically involves validating customer identification data, risk ratings, and documentation to confirm accuracy and completeness. Firms often undertake remediation projects after discovering outdated records, during mergers or acquisitions, or following feedback from regulators or internal audits.

KYC Refresh is a scheduled, risk-based update of customer information conducted at regular intervals as part of ongoing due diligence. KYC Remediation, in contrast, is a one-off or large-scale corrective process triggered by a regulatory finding, internal review, or structural change such as a system migration or acquisition. Remediation usually involves deeper re-verification of existing customer data and documentation.

In banking, remediation refers to identifying and fixing gaps in customer due-diligence records or compliance processes to ensure full regulatory alignment. It can include updating customer files, re-assessing risk classifications, and ensuring that all required KYC documentation is properly stored and verified. This is particularly important for complex banking networks such as correspondent or wholesale banking due to regulatory complexity across jurisdictions and the need to establish a risk-based approach.

Knowledge Hub

The KYC360 platform has helped companies remediate a large number of customers in short time scales. Take a look at our case studies to read their stories.

Explore all our case studiesHow We Helped Remediate 150k Customers in 3 Months

How We Validated Customer Addresses Efficiently

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.

Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, Screening, Perpetual KYC (pKYC) and CLM tasks, with market-leading data sources pre-integrated under a single license agreement. Live risk scoring and automated data collection enables a shift from periodic to event-driven review, while providing a single actionable picture of real-time risk with all documents and data in one place.