How KYC360 helps automate customer onboarding

Create the right first impression with your clients and reduce time to revenue with our market leading, dynamic digital KYC onboarding software. Whether your challenge is retail onboarding at scale or navigating highly complex client relationships, our flexible, award-winning solution will enable you to drive efficiencies and deliver superior customer experience.

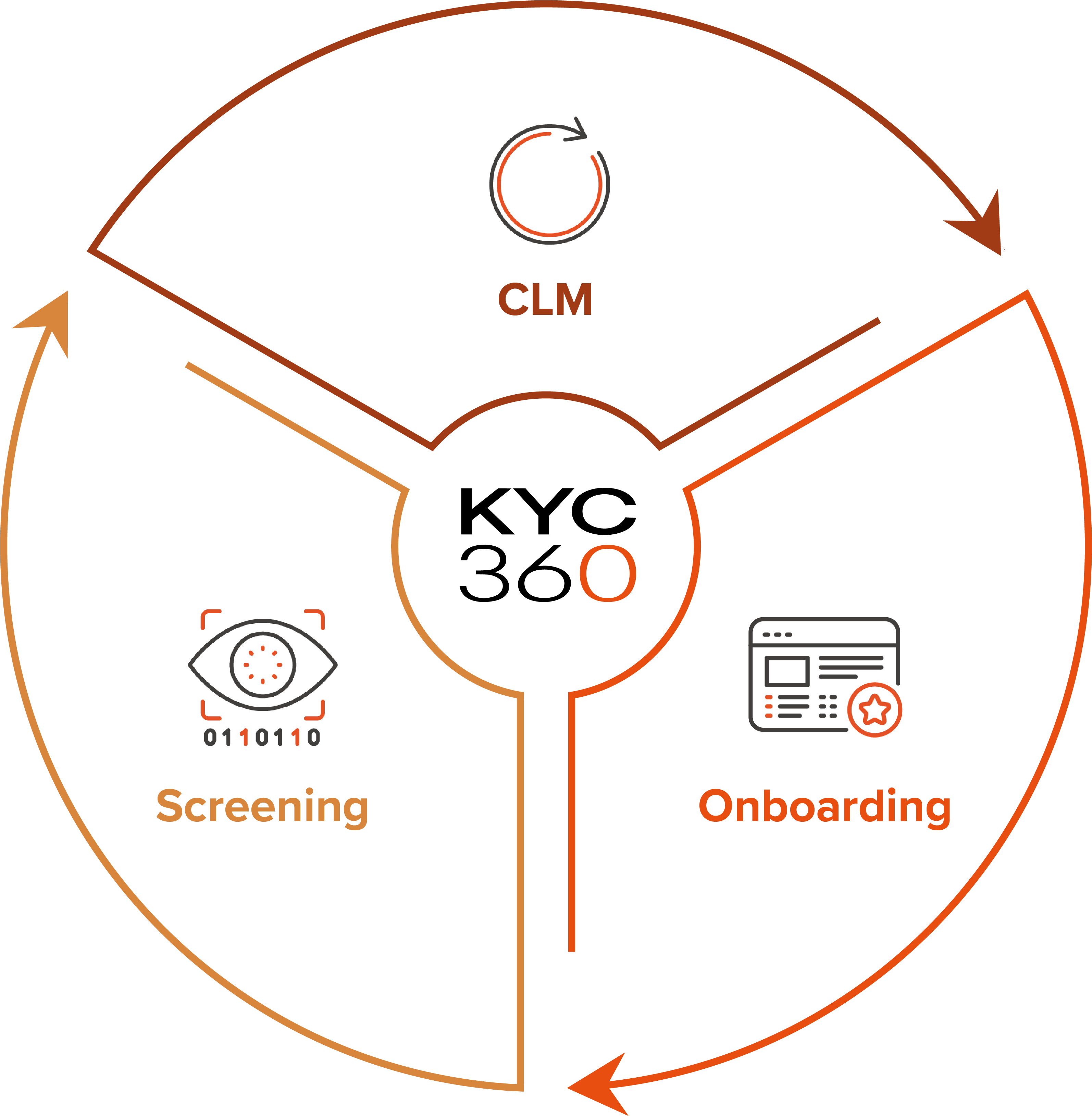

The end-to-end KYC360 platform enables screening and CLM to be added seamlessly to your KYC onboarding flows.

Benefits & Features

Onboarding complex clients

Onboarding complex client entities is challenging due to the intricate and interconnected nature of underlying UBO structures. As a result, the process is often slow, linear and frustrating for all parties.

We’ve reimagined the complex client KYC onboarding process by applying cutting edge technology to solve the most difficult onboarding challenge faced by the financial services industry. Our flexible architecture simplifies the task of onboarding trust, fund, corporate and other complex entity types. Available out of the box as a white-label platform with full no-code configuration.

- Reduce time to revenue for complex client prospects by up to 80%

- Improve customer experience by reducing the number of touchpoints, through dynamic forms and automated entity creation

- Visualise complex client structures and validate with know your business (KYB) sources

- Flexible risk scoring adapts to your risk appetite at both a member and a structure level

- Rapid data waterfall across multiple vendors to reduce cost and optimise first-time pass rates

Perpetual KYC

After a customer is onboarded, their level of risk can change can shift rapidly. Perpetual KYC (pKYC) ensures that customer due diligence remains continuously up to date through automating ongoing risk monitoring and reducing the need for periodic manual reviews.

The KYC360 pKYC solution is available as an additional module and it allows organisations to proactively detect and respond to risk changes in real time with trigger-based updates, such as an expired document, adverse media, or change of jurisdiction. For full cycle risk management across the entire customer lifecycle, our dedicated CLM solution provides a comprehensive end-to-end approach.

Digital KYC onboarding at scale

At KYC360 we understand that rapid onboarding of high volumes of customers cannot compromise compliance. Speed, scale and compliance are all critical. Onboarding at scale is about so much more than processing power and system resources. To be truly effective every aspect of the process must be optimised ensuring low latency, maximum STP and quality CX.

- Fully automated, risk-based, straight-forward process

- Granular configuration of pass/fail conditions in automated onboarding flows

- Automatic risk engine for live risk scoring of prospects

- Dynamic forms optimise prospect experience by requesting only essential data

- Slick workflow for rapid case resolution where analyst review is required

- Branded email templates with mail merge for rapid automated outreach

- Rapid data waterfall across multiple vendors to reduce cost and optimise first-time pass rates

FAQs

Find answers to common KYC Onboarding questions.

The client onboarding process in KYC involves verifying a new customer’s identity and assessing their risk before establishing a new business relationship. This includes collecting and validating identification documents, screening against sanctions and politically exposed persons (PEP) lists, and performing due diligence checks. The goal is to ensure regulatory compliance and prevent financial crime from the very start of the customer lifecycle.

A KYC onboarding checklist should include key steps such as Customer Due Diligence (CDD) to verify identities and assess risk levels, and Enhanced Due Diligence (EDD) for higher-risk clients. It should also cover sanctions screening, beneficial ownership verification, and record-keeping. Using client onboarding KYC software helps automate these processes, ensuring enhanced customer experience and faster onboarding.

Knowledge Hub

The KYC360 platform has helped companies automate their customer onboarding process. Take a look at our case studies to read their stories.

Explore all our case studiesRevolutionising onboarding and screening for Altum Group

Transforming onboarding and screening for CoinPayments

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.

Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, Screening, Perpetual KYC (pKYC) and CLM tasks, with market-leading data sources pre-integrated under a single license agreement. Live risk scoring and automated data collection enables a shift from periodic to event-driven review, while providing a single actionable picture of real-time risk with all documents and data in one place.