Swiss-Asia Financial Services (SAFS) are a wealth and fund management company that specialises in Asian investments from its offices in Hong Kong and Singapore. The company was fined S$2.5 million (US$1.8 million) on May 7th by the Monetary Authority of Singapore (MAS) for multiple AML/CFT breaches. The breaches occurred between September 2015 and October 2018, when the company experienced significant growth.

Breaches

MAS uncovered several breaches in their investigation. These include:

- “Failure to take into account certain relevant risk factors relating to the company’s customers and business activities in its enterprise-wide risk assessment (EWRA)

- Failure to perform customer due diligence (CDD) measures before establishing business relations. SAFS’ practice was to establish business relations with customers before CDD measures were completed

- Failure to scrutinise multiple third-party transactions in customers’ accounts even though the transactions were not consistent with SAFS’ knowledge of the customers

- Failure to identify a number of customers to be of higher money laundering or terrorism financing (ML/TF) risk even though there were red flags

- Failure to submit suspicious transaction reports in relation to several customers even though there was sufficient basis to do so

- Failure to conduct any internal audit to monitor the effectiveness of the company’s AML/CFT controls and its compliance with regulatory requirements.”

SAFS have taken remedial actions to remedy the noted deficiencies.

Closing Thoughts

These failings and the subsequent enforcement actions highlight the importance for financial firms to have adequate Perpetual KYC and Remediation processes in place to ensure they are conducting sufficient customer due diligence and being aware of changing risk-profiles quickly. Applying bare minimum measures leaves them vulnerable to risk and similar enforcement actions.

Compliance is typically seen as a barrier to growth, and this example of SAFS is one where a firm grew quickly and compliance processes were unable to keep up with the rapid expansion. However, technology and automation mean that compliance does not have to be a barrier to growth. Instead of relying on outdated manual processes, firms must utilise automated solutions that are scalable and can generate operational efficiencies.

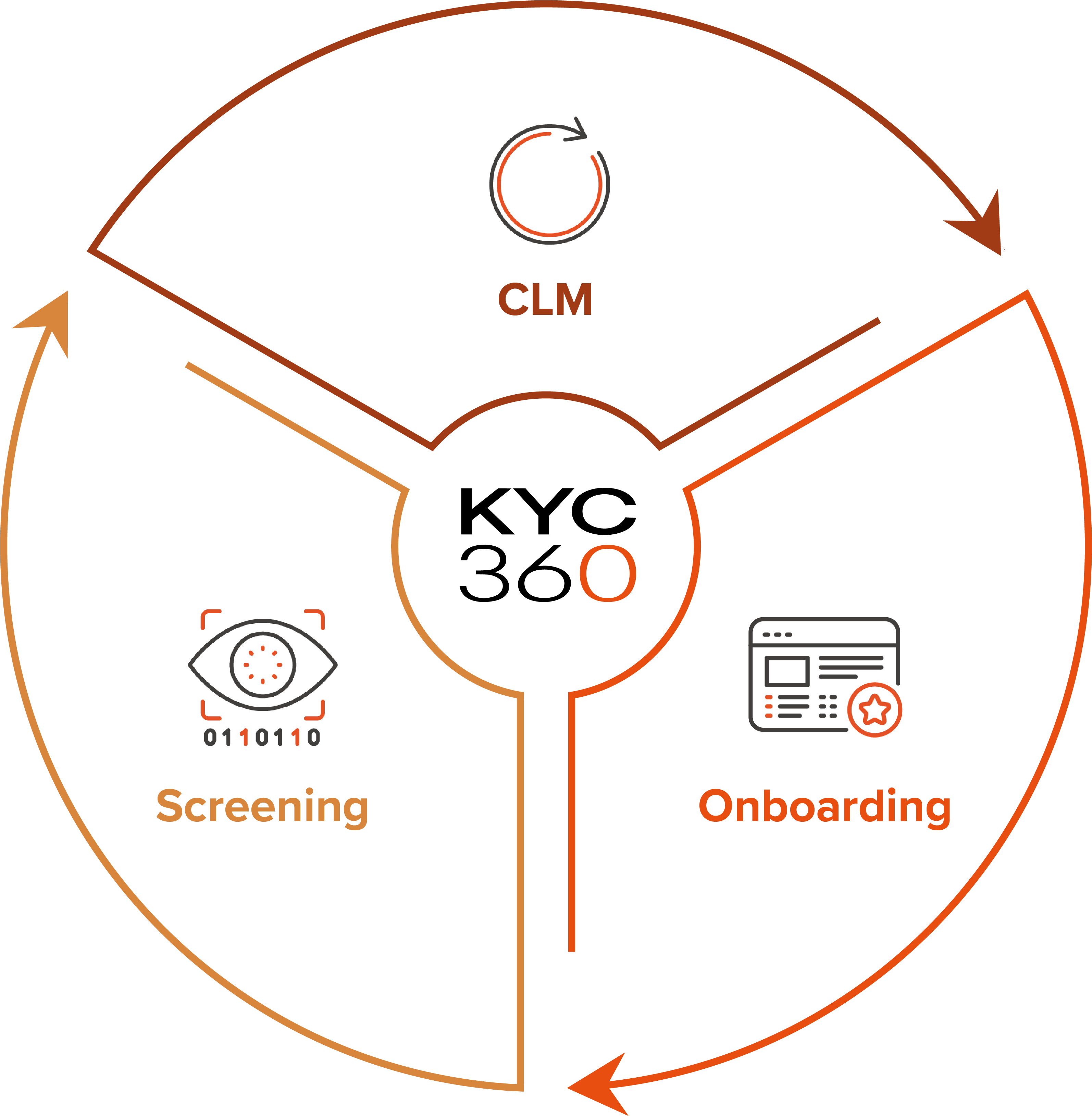

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.