Applying the Formula 1 Approach to Customer Risk Oversight

As compliance teams modernise and adapt to a more stringent regulatory landscape and more sophisticated financial crime threats, automation is gaining ground. Yet many firms still depend on manual reviews, spreadsheets, and static documentation. In a world where risk shifts by the hour, that approach leaves blind spots.

This article explores why continuous, data-driven oversight is quickly becoming essential, and how lessons from Formula 1 risk management can help financial institutions stay compliant while outperforming commercially.

A Snapshot of Current Industry Practices

A live poll at a recent session in Jersey with compliance leaders offered a revealing snapshot of current industry practice.

Screening

The poll revealed that sanctions and PEP screening is one area that has seen significant automation, with 77% of respondents automating these daily. However, 23% still conduct these manually or on a periodic basis, which can lead to risk exposure in the fast-moving sanctions landscape. For firms to remain competitive, they must look to proactively move their highly trained skills away from hours of low value manual tasks and instead allow them to focus on high value analysis and align resource to risk.

Onboarding

79% collect customer data via email and PDF, highlighting how onboarding remains largely manual and inefficient. This slows down time to value for firms and leads to a poorer client experience. Frequent manual rekeying of client data also increases the risk of data quality issues.

Verifying UBOs

For verifying UBOs, 71% of respondents depend on declarations and certified documents, with only 8% using integrated KYB/registry feeds. 89% manually update structure charts, which poses a heavy operational burden and increases the risk of errors.

Risk Assessments

42% continue to use spreadsheets for risk assessments and fewer than 10% assess risk dynamically in real time. Screening processes have modernised, but the broader risk management across the customer lifecycle remains predominantly manual, constraining both efficiency and scalability.

The Evolving Risk Landscape

Global standards and regulations mandate a risk-based approach, requiring firms to align oversight with the level and nature of customer risk. Effective compliance systems not only help avoid costly enforcement actions and reputational damage, but they also enable sustainable, defensible growth.

Static, spreadsheet-based periodic reviews cannot keep pace with continuous changes such as ownership shifts, new screening results, evolving regulations and emerging jurisdictional risks. Each change creates an exposure window until the next review cycle. Therefore, firms must monitor risk continuously so they can act proactively to keep ahead of increasingly innovative criminal threats.

Lessons from Formula 1

Compliance is often viewed as a cost centre that slows down commercial growth. Formula 1 proves the opposite: performance accelerates when risk is managed effectively.

The sport’s turning point came after decades of tragedy. Between 1950 and 1994, 52 drivers died. Following Ayrton Senna’s death, the sport rebuilt its safety framework, expanding real-time telemetry, predictive crash modelling, and continuous engineering feedback. Since 1994, only one driver has lost their life in a race, while average lap times have increased. Rigorous, data-driven risk management made Formula 1 faster and safer.

Applying the Formula 1 Approach to Financial Crime Risk

Financial institutions can draw the same lesson. By replacing static reviews with live, data-driven oversight, compliance shifts from a constraint to an enabler of growth. Like F1, competition in the financial sector is fierce - but it is the way in which you comply that ensures that you outperform.

Real-Time Analysis: Monitor and act on KYC data dynamically

Formula 1 cars generate over a million data points per second. Anomalies such as a spike in gear-change signatures are flagged instantly so the team can intervene before a driver even feels a problem. For financial services, changes in ownership or control of associated entities often surface only at periodic reviews. In contrast, a live approach to risk alerts firms the moment risk conditions change, strengthening decision making and confidence in performance.

Predictive Modelling: Anticipate risks before they materialise

F1 teams track variables like engine and exhaust temperature to predict a failure several laps in advance. They then adjust settings before damage occurs. The same telemetry has even been applied in paediatric cardiac units to provide early warning of adverse events. Financial institutions can mirror this approach by monitoring precursors such as live adverse media signals, anticipating heightened risk rather than reacting only when it is visible.

Continuous Refinement: Use past insights to improve future systems

Stricter regulations limit how F1 teams can innovate, yet the best extract every possible lesson from historic telemetry to keep improving performance. Financial institutions face a similar landscape. The more regulatory scrutiny intensifies, the more firms must learn from every review cycle. Technology can support this process by embedding insight into workflows, improving oversight over time.

AI and Automation: Reduce manual workload and enhance detection

Experience is valuable, but assumptions based on past conditions can fail when the environment changes. McLaren demonstrated this when modelling showed that an early pit stop would outperform traditional strategy. Their counter-intuitive decision led to a first and third place finish, while teams relying on instinct lost ground. Automated analysis in financial crime detection allows the same confidence to break from outdated operating norms.

Culture and Collaboration: Build a culture that adapts to change

Effective risk management depends on people, process, and technology working together. Change is uncomfortable, and compliance functions often face resistance when modernising. In F1, the halo safety device was initially opposed by drivers until the data proved it would save lives. Organisations benefit from a similar culture of psychological safety, where experimentation is encouraged and early adopters help others adapt quickly and confidently.

Implementing a Digitised, Risk-Based Approach Across the Customer Lifecycle

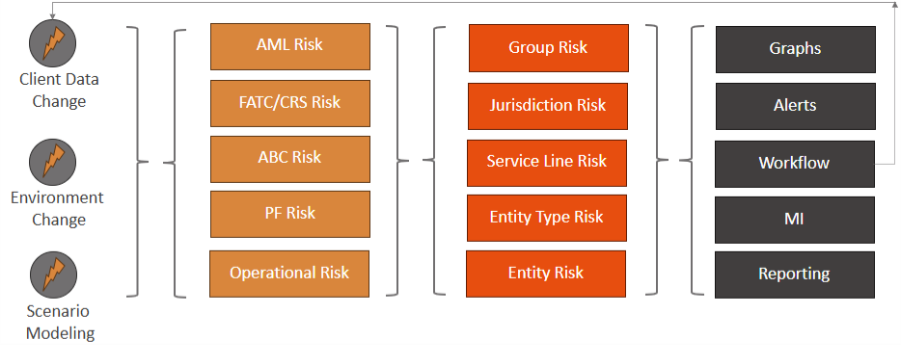

KYC360 incorporates the lessons from the F1 mindset across its solutions. The Customer Lifecycle Management (CLM) solution enables a connected, end-to-end approach to proactive risk management across the customer lifecycle. Firms can unify onboarding, ongoing risk assessment, and automate periodic reviews in one platform.Key benefits include:

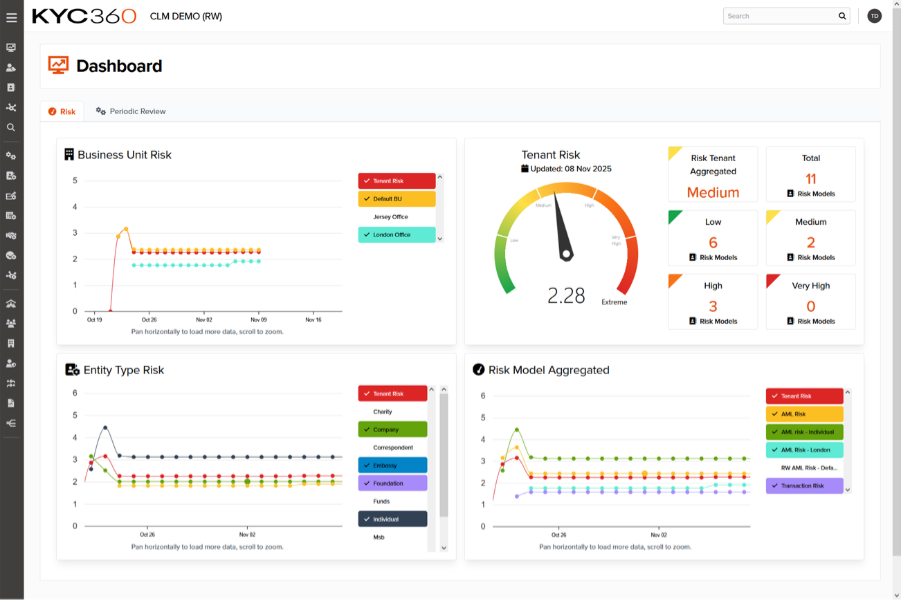

- Real-time dashboards for proactive oversight

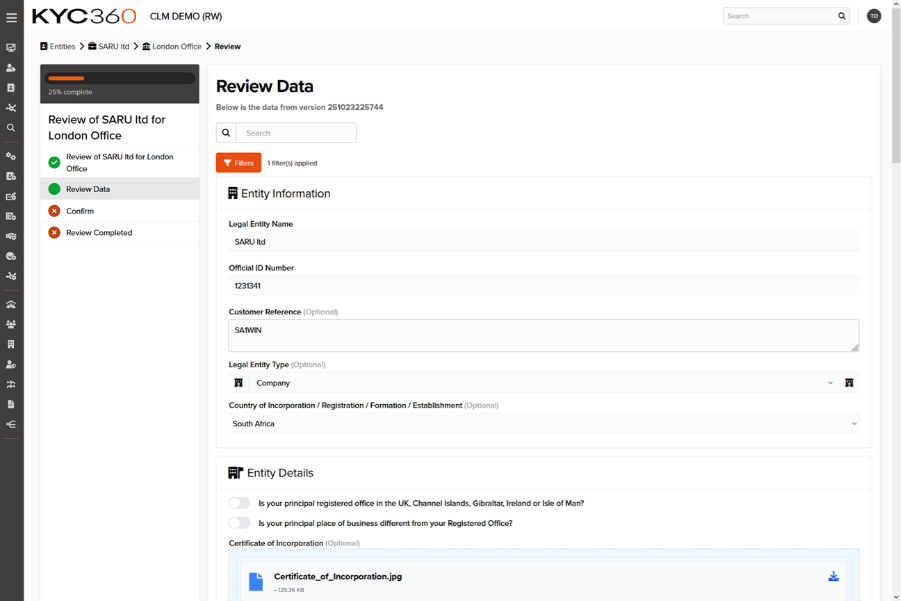

- Event-driven reviews that replace manual workflows and rekeying

- Instant response to risk changes, improving customer trust and retention.

- Modelling the impact of risk model changes or changes to underlying data before they take effect.

- Granular permissions so teams only access what is relevant to their responsibilities.

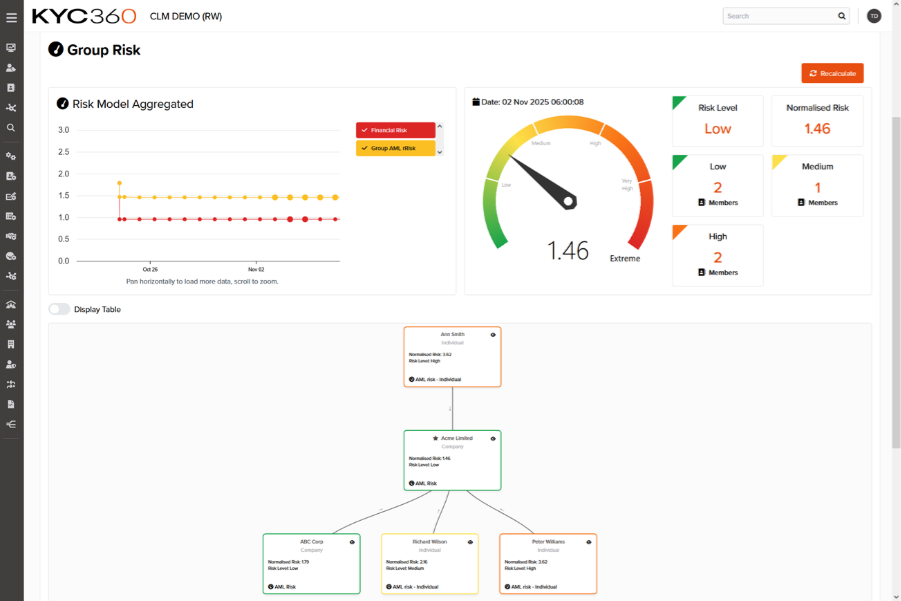

Operate multiple risk models simultaneously on the same customer relationship

Track multiple types of risk with live scoring

Visualise interconnected entities and risk types across complex ownership structures

Complete outreach to customers by easily nominating fields that need to be updated and avoid rekeying of data.

Conclusion

Risk management no longer belongs in spreadsheets or static reports. Firms moving toward continuous, data-driven oversight can do more, better business faster.

See how KYC360 CLM enables live risk management across the entire customer lifecycle.