Batch Screening vs Real-Time Point Screening

The key differences

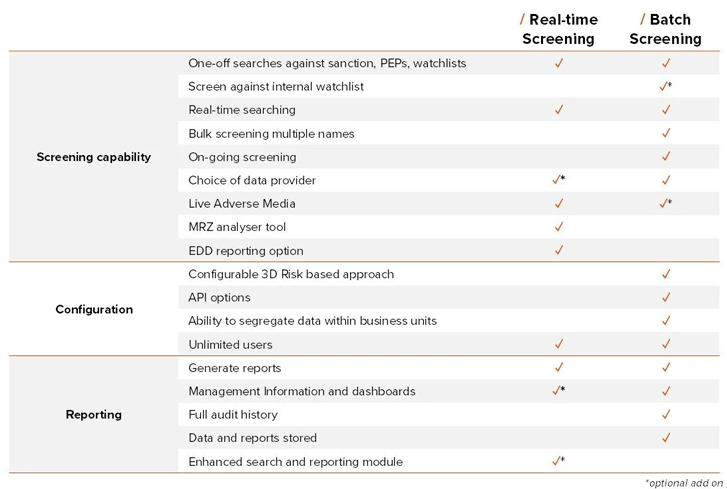

Key Differences between Batch Screening and Real-Time Point Screening

Why Screening is important for compliance

Screening customers against Politically Exposed Persons (PEPs), sanctions lists (such as the OFAC in the U.S. and OFSI in the UK), and adverse media is critical for fraud prevention and regulatory compliance. It is mandated part of FATF recommendations, the EU’s AMLD and other global AML frameworks.

Automated batch screening allows organisations to efficiently process a large volume of customers, ensuring compliance for periodic reviews. In comparison, real-time point screening offers flexibility to assess individual customers in real time, which supports risk-based decision making and investigations into suspicious activity.

Real-Time Point Screening

RiskScreen, powered by KYC360 technology, allows users to easily conduct one-off searches in real time. Searches are conducted using credits and you can see the full pricing here. This simple and intuitive solution is ideal for conducting rapid one-off searches as often as needed on any desktop or mobile device. The solution can be used by an unlimited number of employees within the same organisation at no extra cost. Get started in minutes.

Benefits of Real-Time Point Screening

- Screen individuals and companies online in real time

- Includes alias names for 'bad actors'

- Common name variants, across multiple languages

- Control risk-based search parameters

- Exclude irrelevant URLs

- Red flag results of interest

- Consolidate findings in a single report for future audit purposes

- Include your assessment of the search subject’s risk level based upon search results

- Add comments for improved communication

- Optional MRZ analyser allowing you to analyse and validate passport data

Batch Screening

Batch Screening is an award-winning module of KYC360's Customer Lifecycle Management platform. The solution is designed to enable businesses to screen volumes of customers (from hundreds to millions of names) overnight in a fully automated and risk-based manner. The solution also includes an option to screen higher risk customers against adverse media sources.

Benefits of Batch Screening

- Virtually eliminate false positives with the world’s first truly risk-based batch screening engine

- Handle tens of millions of names at all risk levels

- Fully integrated with the world's best data sets from Dow Jones, World-Check and Lexis Nexis providing you with maximum optionality

- Complete workflow and audit capture – All activity at any single moment in time is captured for audit purposes

- Laser-sharp MI and reporting

- Super-flexible integrations

Batch Screening and Real-Time Screening: A Hybrid Approach

A hybrid screening approach enhances compliance by combing batch screening for ongoing customer monitoring and continuous due diligence with real-time point screening for live risk assessment that allows organisations to evaluate new customers and assess potential risks before engagement.

Knowledge Hub

The KYC360 platform has helped global companies transform their compliance process and deliver outstanding customer experience, with batch screening. Look at our KYC batch screening case studies to read their stories.

Explore all our case studiesHow we helped Oak Group unify their screening processes

Transforming Onboarding and Screening for VEON

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.

Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, Screening, Perpetual KYC (pKYC) and CLM tasks, with market-leading data sources pre-integrated under a single license agreement. Live risk scoring and automated data collection enables a shift from periodic to event-driven review, while providing a single actionable picture of real-time risk with all documents and data in one place.