2024 Gambling Playbook

Compliance as a Competitive Advantage

Unlocking Compliance as a Growth Enabler

Uncertainty appears to be the theme of gambling & gaming regulation in 2024 and beyond. Operators in the space already contend with complex regulatory standards with little cross-border consistency and a large volume of updates that can be difficult to implement. New regulations often come in with little warning, which forces compliance teams to adapt quickly. Additionally, they face pressures from commercial teams to scale quickly and onboard a greater volume of players.

Safer gambling measures remain a key priority for regulators around the world and protecting players is critical. There is pressure from both the public and from governments to minimise gambling harm. The UK has already acted on White Paper consultations by applying stake limits on slots and new measures will likely come in. Other regulators will be watching closely and may consider implementing similar initiatives. Therefore, operators must be prepared for changes in the regulatory landscape to adapt quickly.

In this guide, we look at how gambling and gaming operators can adapt and successfully thrive in a fast-changing landscape.

The Regulatory Landscape

UK

All eyes in the UK are on the findings of the long-awaited gambling White Paper which was released in 2023. It made a number of recommendations that are likely to take years to implement and new measures could include financial risk checks. Alongside this, the Gambling Commission has set up the largest gambling survey to date in the UK, with the results likely to impact on implementation of new measures.

Europe

In the EU, there is an on-going effort to harmonise frameworks across member states to prioritise responsible gambling and ensure player protection. Currently, regulators tend to operate individually, and the fragmented nature of frameworks makes it difficult for firms to ensure compliance with these differing frameworks.

The level of regulations can be significantly different between member states, with some outright banning them, and others establishing a monopoly for online operators or issuing licenses to operate gambling services. Operators should expect tightening regulations across EU countries to enhance player protections, but the specific implementations are likely to differ widely.

🟩Legal and regulated 🟨Partially legal 🟥Monopoly or illegal

🟩Legal and regulated 🟨Partially legal 🟥Monopoly or illegal

The Americas

Developing markets are quickly growing across the Americas and they may look to the actions of regulators in established markets in Europe on effectively safeguarding player safety.

U.S.

🟩Legal and regulated 🟨Partially legal 🟥Monopoly or illegal

Currently, gaming is legal in some form in 48 states, with sporting betting legalised in 36 states. The U.S. market continues to grow with Statista projecting online gaming revenue to reach $23.03bn in 2024 and $35.21bn by 2029.

With increasing profits comes increasing regulatory scrutiny. As expansion continues in this sector, regulatory authorities will be looking to more established markets to ensure social responsibility obligations are met and money laundering risks are mitigated. Gaming operators looking to take advantage of growth and establish themselves in the states should remain wary of evolving regulations and potential enforcement actions. By developing a robust and scalable compliance process, they can take full advantage of growth opportunities without losing compliance assurance.

Latin America

In Latin America, the top six markets Brazil, Mexico, Colombia, Chile, Argentina together has a 38% projected annual growth rate to 2026.

🟩Legal and regulated 🟨Partially legal 🟥Monopoly or illegal

Brazil legalised online gambling in late 2023 and a regulatory framework is set to be implemented in 2024. Meanwhile in Mexico, the decision to not renew licenses of gaming halls and casinos has led to an uptick in online gambling. As with the U.S, countries in this region are likely to introduce additional regulations to ensure play protection mechanisms are sufficiently robust.

Middle East

Due to strict Islamic Laws in Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia there is a ban on any gambling activity. However, citizens have turned to unregulated offshore online platforms, using VPNs. The region is also becoming a hotspot for esports. Elsewhere in the region, the UAE has a created a new regulatory body to oversee commercial gaming. This body would create a “regulatory framework for a national lottery and commercial gaming,”. There is uncertainty around the makeup of final regulations, however operators are already taking steps to prepare for the market opening.

Managing Requirements in an Uncertain Landscape

AML

The huge amounts of money being spent in online gambling makes it a key target for fraudsters and money launderers. As a result, regulatory frameworks across jurisdictions prioritise AML/ CFT measures. Gambling is one of the few industries beyond financial services to count as part of the regulated sector for the purposes of money laundering legislation. Sanctions for AML failings can include significant fines which can impede growth. However, sanctions do not stop at fines as regulators are considering looking at stronger sanctions that could include revoking personal management or corporate operating licenses. That would present significant difficulties for gaming and gambling companies.

Know Your Customer (KYC)

The industry was one of the first to embrace digital identity and technology innovations are making onboarding faster, but this comes with additional regulatory considerations. Faster onboarding must be balanced with compliance assurance to streamline this process effectively. It is vital for operators to know that players are genuine and old enough to legally gamble and that they can pass responsible gambling checks. However, for gambling and gaming companies to scale they must also prioritise a frictionless onboarding experience to promote player loyalty. Operators must remain mindful of new regulations related to KYC as more stringent measures come in to protect players against gambling harm.

Data Regulation

Gambling and gaming companies operating in Europe are subject to GDPR and companies must remain wary of potential changes to data regulation measures worldwide. It is the responsibility of operators to protect sensitive customer data from breaches, unauthorised access and cyber threats. Robust data security measures, such as encryption, secure storage and adherence to data protection regulations, are essential for maintaining customer trust and compliance. The cost of non-compliance is high and major fines have been handed out in recent years for data protection breaches.

Balancing compliance with growth goals

Markets are growing quickly globally and Statista projects revenue in the Online Gambling market to reach $100.90bn in 2024 with an annual growth rate of 6.2% to 2029. With these lucrative opportunities comes immense pressure to scale quickly and onboard a higher volume of players efficiently. This creates a balancing act between the need to remain compliant with fast changing regulations and the need to commercially outperform.

The cost of non-compliance remains high with gambling operators paying $250 million in penalties for AML, responsible gambling and compliance failures in 2022. However, compliance and commercial interests do not necessarily need be seen as competing interests. Instead, the compliance function can be seen as a growth enabler rather than a stifler.

How to Manage the Challenge

Managing the challenge of remaining compliant in a constantly evolving landscape is no easy feat, especially with commercial pressures to outperform. Technology plays a vital role in automating processes and making them more efficient. A regulatory solution that can be applied throughout the entire customer lifecycle is vital.

|

The manual approach The traditional manual approaches to AML/CFT and KYC compliance are increasingly impractical for the modern gaming/gambling industry. Operators must keep up with fast-evolving regulations or risk reputational damage, fines and even the loss of their license. |

|

Technology innovations Innovative technology enables automation of screening and onboarding at scale without losing compliance assurance. New technologies can also improve user experience by reducing onboarding friction for new users, leading to lower churn rates and increased player loyalty. Providing a frictionless onboarding experience also means that users are less likely to turn to the black market with unregulated operators. Gambling and gaming companies can also benefit from an audit trail that allows them to more efficiently account their activities to regulators and stakeholders. |

|

Scaling with compliance The top players in the industry prioritise compliance assurance with scalable processes which enables them to support commercial goals. Using innovative technologies helps operators stay ahead of regulatory changes and allows them to manage jurisdictional complexity without losing compliance assurance. In a fast-growing market, driving scalability is key for operators. They face a number of important |

RegTech Buyers Checklist

To deal with these challenges, gambling and gaming companies require a scalable lifecycle management solution that allows them to outperform commercially while maintaining compliance assurance. Here’s your essential checklist when deciding on a regulatory compliance partner and the key features to look out for.

1. Industry expertise

How well does the regtech provider understand the nuanced regulatory challenges of the gaming and gambling industry?

You should be confident that the provider is knowledgeable about the industry and can help you utilise compliance to outperform. They should also have capabilities to keep you updated with regulations across the world, which can differ widely and come in quickly.

2. Support

Even the best tools are rendered ineffective if there is no adequate support. A provider must ensure they can quickly address any issues or challenges with implementation. The high costs of non-compliance make it essential to have assurance that the regtech provider can provide effective support quickly, which allows you to take full advantage of automation to remain compliant and frees up capacity for commercial priorities.

3. Ease of integration

Securing ROI gains with a compliance partner requires effective integration with your existing processes. A provider should make it easy to integrate their solution into your workflows. Else, you may be waiting months or even years before your team can take full advantage of the automation. Different businesses can have widely varying infrastructures, which makes it pivotal for a provider to have the flexibility that can enable rapid ROI.

4. User experience

A solution that delivers a frictionless experience for the end user is vital. A fast and convenient onboarding process reduces prospect drop off and churn. This streamlined process must also be combined with compliance assurance that adheres to responsible gambling regulations. Operators using regtech providers that deliver an outstanding user experience can successfully gain a competitive advantage.

5. End-to-end lifecycle coverage

Compliance does not end after a user is screened and onboarded. It is an ongoing process that continues throughout the user’s lifecycle. Automatic outreach and risk-based refresh means a better user experience and greater efficiencies for a company in comparison to manual methods of managing risk.

6. Reliability

Compliance is non-negotiable. You must be able to trust that your provider can successfully enable you to screen, onboard, and dynamically manage risk while adhering to AML/CFT and KYC legislation in the relevant jurisdictions. You require technologies that can reliably verify age, detect potential fraud and red flags, and support responsible gaming measures.

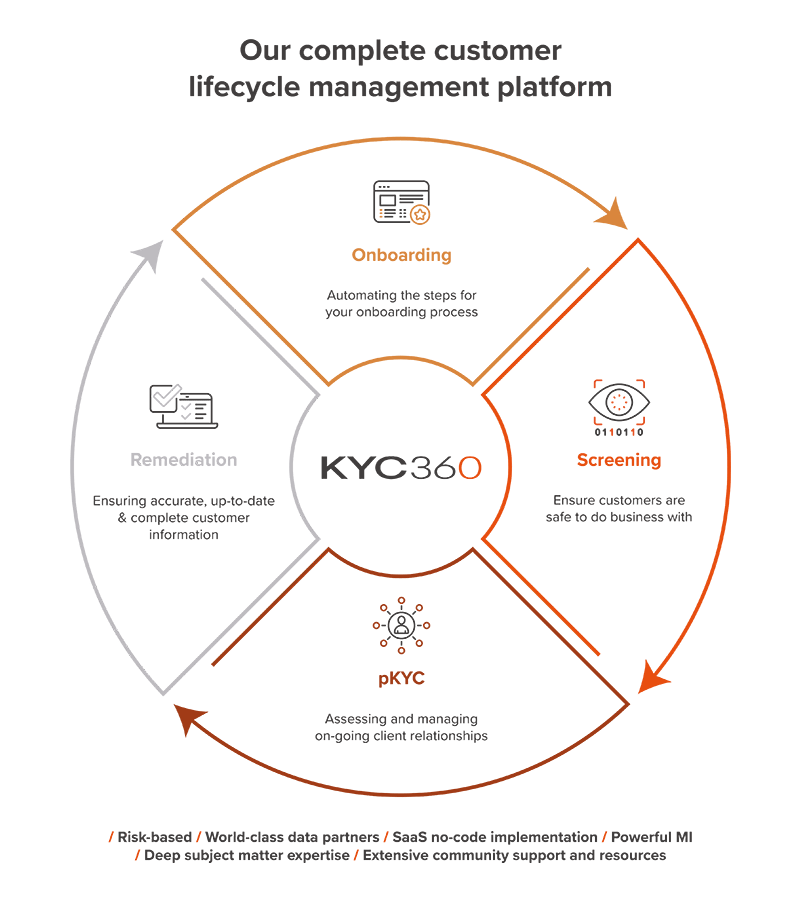

Comply and Outperform with KYC360

Until now, compliance has been a barrier to business - it’s made doing business slower and more difficult by creating friction through clunky processes, siloed data and human error. The opportunity now exists for organisations to outperform commercially through the way they comply. Compliance has evolved from being a barrier to becoming a major point of difference in how businesses accelerate time to revenue, increase profitability and improve customer experience.

Our Customer Lifecycle Management SaaS Platform takes care of all aspects, from creating the right first impression with rapid risk-based onboarding, through to award winning screening and KYC refresh that enable your business to:

-

Realise massive operational efficiencies

-

Achieve rapid ROI through the speedy deployment of our no code solutions and

-

Master complexity with solutions that evolve as regulations change

All at the same time as delivering even higher levels of compliance assurance.