Quantios and KYC360

Formerly known as TrustQuay

Quantios, formerly known as TrustQuay and Viewpoint, are the global leader in technology for the trust, corporate services and alternative fund administration markets. With 30 years’ experience, Quantios serves more than 450 clients and 17,500 users in over 30 jurisdictions, through 9 offices worldwide in key markets including Australia, Guernsey, Jersey, Luxembourg, Singapore and the United Kingdom.

Seamless AML screening for Corporate Services, Trust & Fund Administrators

The partnership with KYC360 offers a fully integrated "out-of-the-box" experience for users of Quantios to perform risk-based customer screening, in bulk, using a choice of world-class data sources, Dow Jones or LSEG World-Check.

The combination of technology results in accelerated time to revenue, improved operational efficiencies (reducing false positives by 95%) and increased levels of AML assurance.

- Reduce friction by automatically screening your customers in QuantiosNav, QuantiosCore and QuantiosVP

- Choose between two of the world leading risk and compliance data sources, Dow Jones or LSEG World-Check

- Fully automated, 3D risk-based screening reducing false positives by 95% without any loss of assurance

- Most operationally efficient handling by means of potential match triage and bulk handling

- Prove your findings in every step of the process, in any point in time and provide credible answers to the regulator or internal teams with tangible proof points

- Comprehensive audit and regulatory reporting - designed by financial crime barristers who have asked all of the difficult questions during the course of their regulatory investigations

- Reduce database size and complexity while improving quality of compliance

- Easy to implement

- Unlimited user licence

Seamless, pre-built connector with Quantios

Seamless, pre-built connector with Quantios

- Easy selection of data to be sent to KYC360 for daily screening (no export/import spreadsheets or complex integration required)

- Risk assessed in QuantiosNav, QuantiosCore and QuantiosVP dynamically drives selection of KYC360's 3D risk-based screening criteria

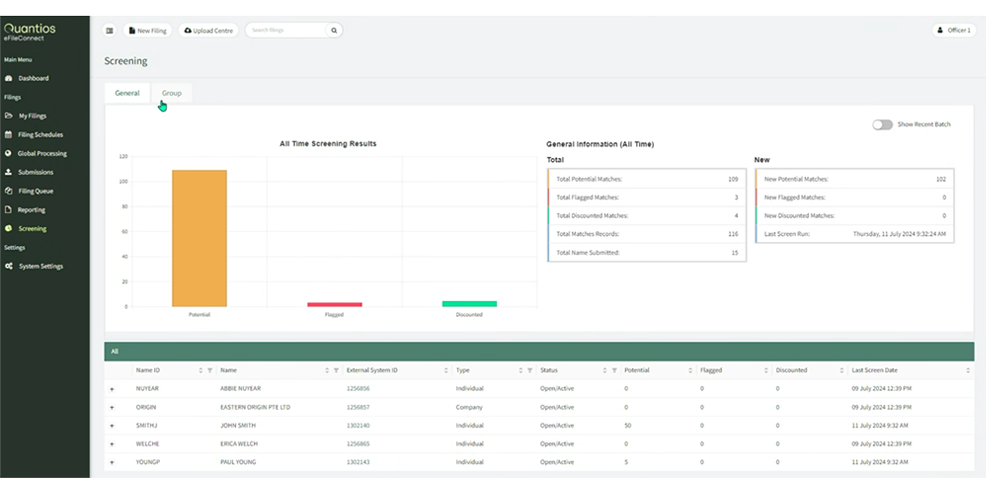

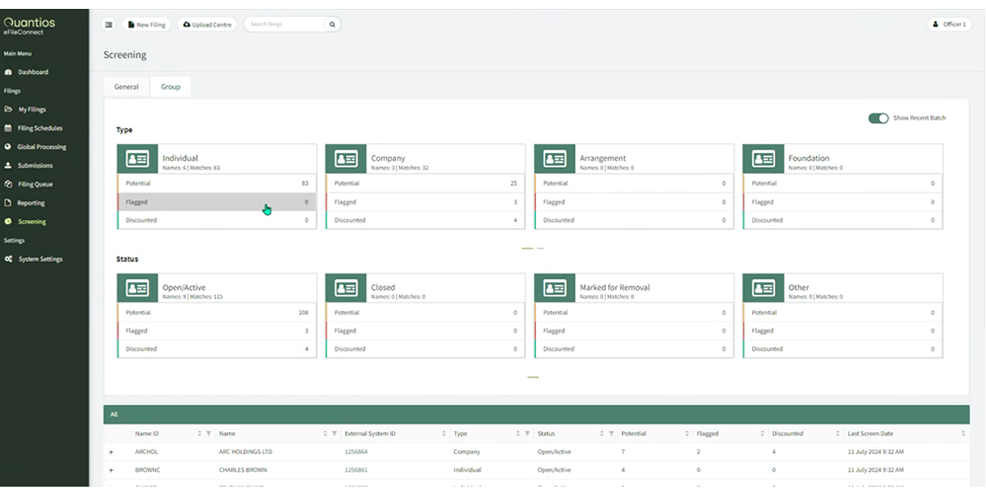

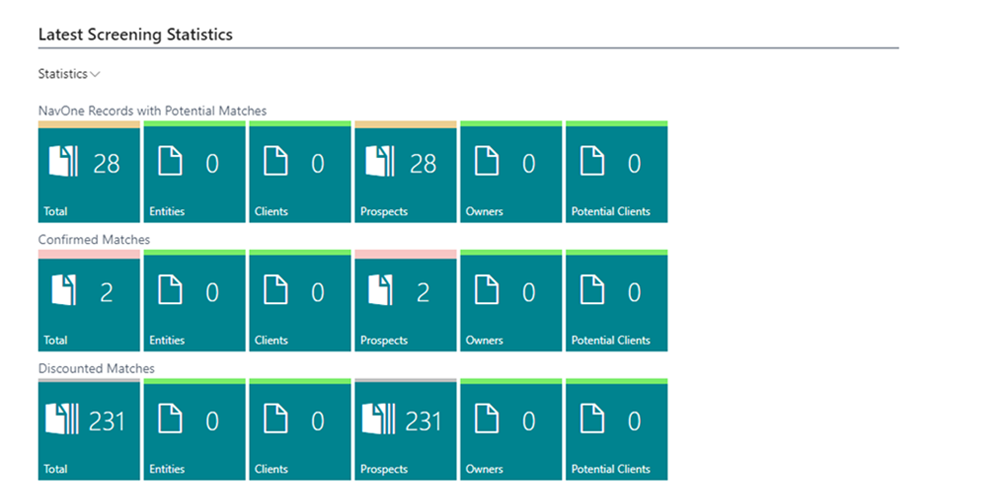

- Dashboards in QuantiosNav, QuantiosCore and QuantiosVP to keep an eye on overnight screening statistics, results and ability to seamlessly click through to KYC360 for maximum handling efficiency and reporting

See it in action

Screening integration with Quantios VP

Knowledge Hub

Drawing on deep subject matter expertise and our many customer and partner relationships globally we deliver valuable insights through weekly KYC newsletters, white papers, podcasts and events.

Explore the Knowledge HubKYC360 Weekly Roundup - 13th February 2026

Top KYC and AML Challenges for Caribbean Insurers