What the Banking Industry Can Learn from Formula 1 about Data-Driven Risk Management

Written by Stephen Platt, CEO KYC360 and Neil Martin former Director of Race Strategy at Ferrari F1 and KYC360 Board Advisor

In the high-stakes world of Formula 1 racing, split-second decisions and finely tuned strategies often separate the champions from the pack. As the pinnacle of motorsport, F1 operates in an environment where a single misstep can lead to catastrophic outcomes—not unlike the high-risk environment of banking. In recent years, the banking industry has increasingly looked toward Formula 1for inspiration, especially when it comes to data analysis and risk management. By observing how F1 teams leverage data to optimize performance, banks can gain valuable insights into improving their risk management processes, enhancing decision-making, and ultimately ensuring more robust financial outcomes.

1. Data Collection: The Foundation of Risk Management

Formula 1 teams gather an astonishing amount of data during every race. A modern F1 car is equipped with over 300 sensors, constantly monitoring everything from tyre pressure and fuel consumption to track conditions and engine performance. Each race generates hundreds of gigabytes of data, which teams analyse in real-time and afterward to gain insights and improve future performance.

Lesson for Banking: Banks, like F1 teams, need to prioritize comprehensive and granular data collection. For banks, this data can include transaction records, customer behaviour, economic indicators, and more. By implementing robust data collection systems and ensuring a continuous flow of relevant information, banks can lay a solid foundation for effective risk management.

Key Takeaway: Just as an F1 team can’t optimize performance without data on every aspect of the car, banks can’t make informed risk assessments without a thorough understanding of their internal and external data environment. Building a comprehensive data infrastructure should be a priority.

2. Real-Time Data Analysis for Agile Decision-Making

In F1, decisions must often be made in fractions of a second. For instance, when changing weather conditions alter the optimal tyre choice mid-race, pit crews and drivers rely on real-time data to make quick adjustments. With the help of predictive analytics, teams can even anticipate changes in race dynamics before they happen, allowing them to proactively mitigate risks.

Lesson for Banking: Financial markets can be just as fast-paced as the F1 track, with real-time developments in global events, interest rates, and currency fluctuations requiring immediate attention. For banks, real-time data analysis tools can play a critical role in monitoring market risks, credit exposure, and liquidity management. By developing real-time dashboards and alert systems, banks can detect potential issues as they arise, rather than only through retrospective analysis.

Key Takeaway: Just as F1 teams rely on real-time data to make in-the-moment adjustments, banks need real-time data analytics to respond to risks proactively. Real-time data is essential for making agile decisions that protect the bank and its clients from sudden shifts.

3. Predictive Analytics and Machine Learning for Strategic Insights

Formula 1 teams use machine learning and predictive analytics to create detailed simulations, allowing them to anticipate race conditions and outcomes. By feeding data from past races and current conditions into sophisticated algorithms, teams can predict how a car will perform and identify potential failure points, whether it’s a specific part or a different driving strategy to protect the car from further damage.

Lesson for Banking: Predictive analytics and machine learning can empower banks to anticipate financial risks. For example, machine learning models can analyze vast amounts of data to forecast credit risk, detect fraud, or assess potential market downturns. Predictive analytics can also provide insights into customer behaviour, helping banks make data-driven lending decisions, set pricing strategies, and improve customer satisfaction.

Key Takeaway: By embracing risk, through the use of predictive analytics, banks can shift from a reactive to a proactive risk management approach. Just as F1 teams use predictions to gain a competitive edge, banks can use them to enhance risk assessment and operational efficiency.

4. Collaboration between Human and Machine for Risk Management

In F1, data is crucial, but it’s only part of the equation. While AI and algorithms analyze data and offer higher fidelity insights and opportunities, it is human drivers and engineers who provide intuition and experience. Engineers interpret data, make judgment calls on what to prioritize, and communicate with drivers, who have the real-world experience of handling the car on the track.

Lesson for Banking: In risk management, data alone isn’t enough—human expertise is essential. While algorithms can provide accurate assessments and predictions, risk managers’ experience and judgment allow them to understand nuances and context that data alone may not reveal. A balanced approach where machine analysis complements human intuition can help banks make better-informed decisions, especially when handling complex risks.

Key Takeaway: Just as F1 relies on synergy between human and machine, banks can benefit from a balanced approach that combines algorithmic insights with human expertise. A collaborative model enhances risk management by leveraging the strengths of both.

5. Scenario Analysis and Stress Testing for Resilience

Formula 1 teams constantly run scenario analyses, simulating every possible condition and outcome. By stress-testing every component of the car and factoring in race-specific scenarios, F1 teams prepare for all possible conditions, reducing the risk of failure on race day.

Lesson for Banking: Banks can apply similar stress-testing techniques to financial risk management. Through scenario analysis, banks can simulate economic downturns, shifts in interest rates, or sector-specific crises to assess their potential impact on the institution. By identifying vulnerabilities in advance, banks can implement contingency plans that ensure resilience in times of crisis.

Key Takeaway: Like F1 teams that prepare for a range of track conditions, banks need to perform regular scenario analyses and stress testing to remain resilient. This enables institutions to identify vulnerabilities and prepare strategies for mitigating risk under a variety of conditions.

6. Continuous Learning and Post-Event Analysis

F1 Teams only operate in terms of outcomes. After each race, F1 teams conduct detailed reviews, examining what worked and what didn’t. Every decision, from tyre choices to fuel management, is scrutinized to inform future races. This culture of continuous learning, understanding outcomes, allows teams to evolve and adapt their strategies based on both successes and failures.

Lesson for Banking: Banks can benefit immensely from post-event analysis, especially after facing a market shock or regulatory change. By reviewing risk management decisions and identifying areas of improvement, banks can continuously enhance their practices. Implementing feedback loops ensures that past events inform future actions, fostering a culture of learning that is essential for long-term resilience.

Key Takeaway: Like F1 teams, banks should establish a routine of post-event analysis. Learning from both successes and failures allows banks to refine their risk management practices continually, staying agile and adaptive in a dynamic industry.

7. Cybersecurity: A Fast-Evolving Threat Landscape

Just as F1 teams constantly upgrade their cars to meet new performance demands, banks must also adapt to a rapidly evolving cyber threat landscape. The data-driven approach F1 teams take—identifying weaknesses, upgrading protections, and anticipating attacks—parallels the cybersecurity strategies banks must adopt. Even if we are winning, complacency is the enemy in F1, and something that drives everything we do to constantly improve.

Lesson for Banking: Cybersecurity risk management requires constant vigilance and real-time monitoring. Banks should adopt a similar approach to F1, treating cybersecurity as a performance factor that’s actively monitored and adjusted. Implementing robust, data-driven cybersecurity protocols, including monitoring of network activity and predictive models for threat detection, can keep banks secure in a fast-evolving digital landscape.

Key Takeaway: Treat cybersecurity as an ever-present risk factor. Continuous data analysis and adaptive cybersecurity measures will ensure banks remain protected from emerging threats.

Conclusion: Applying Formula One’s Data-Driven Approach to Banking Risk Management

The banking industry stands to gain significantly by adopting the data-driven approaches pioneered by Formula One. From real-time monitoring and predictive analytics to scenario analysis and post-event learning, these lessons can help banks build more robust and responsive risk management frameworks. By continuously adapting and optimizing, banks can stay resilient, competitive, and ready for the dynamic financial environment—just as F1 teams race to stay ahead on the track.

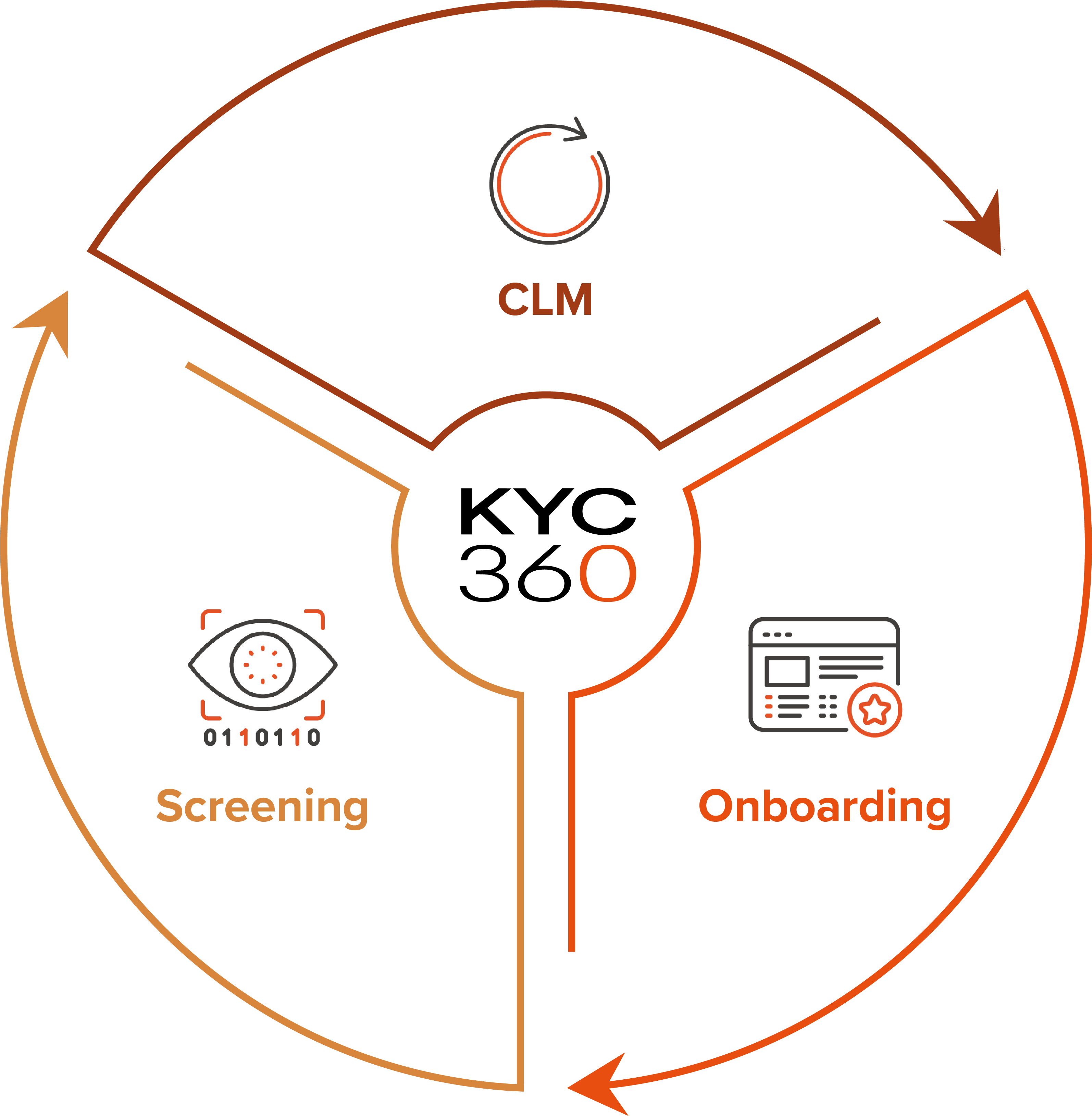

KYC360 is an award winning provider of next generation RegTech solutions that empower businesses to comply and outperform through digitised customer onboarding, screening and customer lifecycle risk management. Neil Martin is the former director of Race Strategy at Ferrari F1 and a Board Advisor to KYC360.

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.