Swiss financial institutions, especially financial intermediaries and asset managers, face mounting regulatory challenges. Compliance teams face growing pressure from outdated manual processes that drain resources and increase the risk of breaches.

Below are the top challenges that they grapple with:

1. Manual periodic reviews

KYC reviews are essential, but when handled manually they are a drain on resources. Slow, error-prone processes increase costs and divert teams away from higher-value tasks.

2. Onboarding bottlenecks

Client onboarding remains a key friction point for Swiss financial intermediaries, especially when dealing with complex structures like trusts or foundations. Incomplete data and inconsistent workflows frustrate both clients and compliance teams. Delayed onboarding means delayed revenue.

3. Manual rekeying of data

Many Swiss firms also contend with regular rekeying of data across disconnected systems. Whether onboarding new clients or refreshing existing client information, staff often input the same information across disparate systems. This is time-consuming and inefficient and increases the risk of errors and non-compliance. It also undermines audit readiness. .

4. Legacy systems and siloed data

Many Swiss firms also contend with regular rekeying of data across disconnected systems. Whether onboarding new clients or refreshing existing client information, staff often input the same information across disparate systems. This is time-consuming and inefficient and increases the risk of errors and non-compliance. It also undermines audit readiness. .

5. RegTech must meet Swiss data standards

Any new solution must comply with strict Swiss data privacy laws and banking standards. A platform must also be able to demonstrate full audibility under FINMA or SRO (such as VQF, OSFIN) oversight.

Conclusion

Overall, Swiss financial institutions aren’t just facing compliance challenges from an evolving regulatory landscape, they also contend with manual KYC reviews, lengthy onboarding processes and manual rekeying of data. All of these contribute to higher costs and operational inefficiencies. As a result, firms require tools that are designed for compliance with Swiss standards, fully aligned with FINMA/SRO requirements and designed for fast deployment and scalability.

Learn more about how Swiss financial institutions can comply and outperform with KYC360’s award-winning technology that is built for rapid implementation and full data security and privacy compliance with Swiss banking standards.

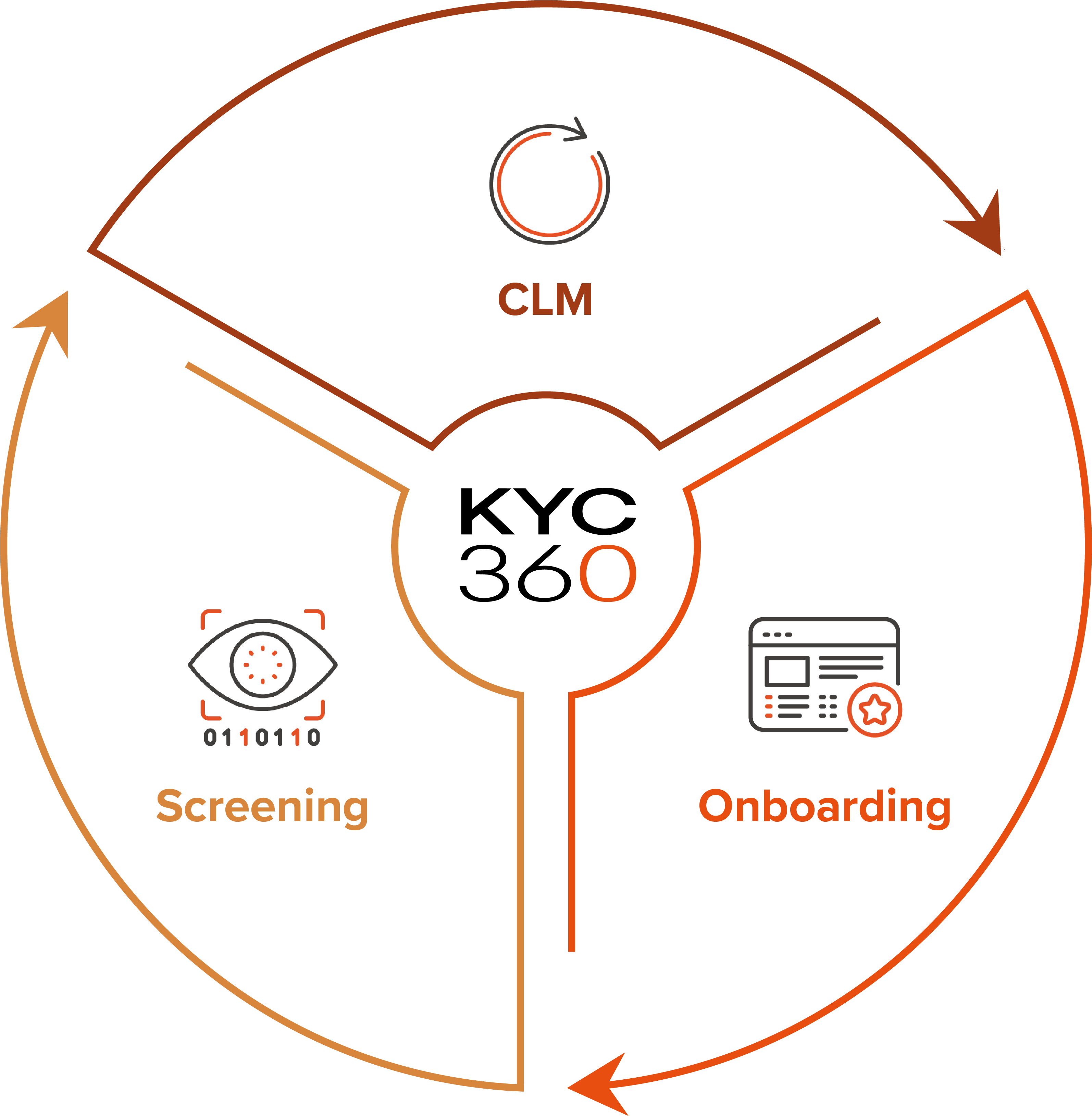

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.