The TD Bank Scandal: How Greed, Hubris, and a Little Bit of “Salesmanship” Turned Canadian Banking Upside Down

Written by Stephen Platt

In a scandal that would make even the most jaded banker blush, TD Bank has been outed for facilitating money laundering on a scale that would impress a Bond villain. FinCEN has slapped the bank with a record $1.3 billion penalty for violations of the Bank Secrecy Act (BSA), the primary U.S. anti-money laundering law. But wait, there’s more. The U.S. Justice Department piled on with an additional $1.8 billion in fines, bringing the grand total to a staggering $3.1 billion. This makes TD Bank the largest financial institution in U.S. history to plead guilty to such egregious violations.

The Causes

For nearly a decade, TD Bank’s anti-money laundering program was defective. Weaknesses in the bank’s transaction monitoring allowed three money laundering networks to move more than $670 million through its accounts between 2019 and 2023. The bank’s compliance culture was so lax that employees openly joked about the lack of oversight. One customer was able to make daily cash deposits of $1 million without raising any red flags. Bank employees received almost $60,000 in gift cards from one money launderer.

The Response

In response to this debacle, TD Bank is now scrambling to clean up its act. The bank has invested $500 million in tightening its AML processes and hired key executives to strengthen compliance. This includes bringing in Georgia Stavridis, the former chief compliance officer of HSBC Bank Canada, as vice president in financial crimes risk management. Senator Elizabeth Warren has criticised the Justice Department’s settlement as too lenient, arguing that it allows banks to treat fines as a cost of doing business rather than a deterrent to illegal activity. In the wake of this scandal, TD Bank’s CEO, Bharat Masrani, has announced his retirement, effective April 2025. The bank has appointed Ray Chun as the incoming CEO, signalling a commitment to compliance and remediation.

This debacle serves as a stark reminder not only of the importance of robust AML compliance programs in the banking industry but also of the criticality of customer KYC remediation. TD Bank’s failures have not only resulted in massive financial penalties but have also severely tarnished its reputation. The bank now faces the daunting task of rebuilding trust with regulators, customers, and the public under the watchful and not inexpensive eye of an external compliance monitor. In addition to being a colossal embarrassment for the bank the episode doesn’t exactly represent the finest hour for US regulators which had been aware of weaknesses in the bank’s transaction monitoring systems for a decade.

Conclusion: The Need for a Reality Check in Modern Banking

In conclusion, TD Bank’s AML scandal is a cautionary tale of what happens when financial institutions prioritise profits over compliance. The record fines and subsequent fallout underscore the critical need for banks to maintain vigilant and effective anti-money laundering programs and accurate data driven customer KYC profiles. As TD Bank works to rectify its shortcomings, the banking industry as a whole must take heed to prevent similar and more costly failures in the future. Watch our latest webinar on-demand and gain insights from Stephen Platt, founder of KYC360 and Tom Devlin, CCO at KYC360, for a deep dive into what went wrong at TD Bank and analysis of the key lessons that financial institutions can learn. Watch now.

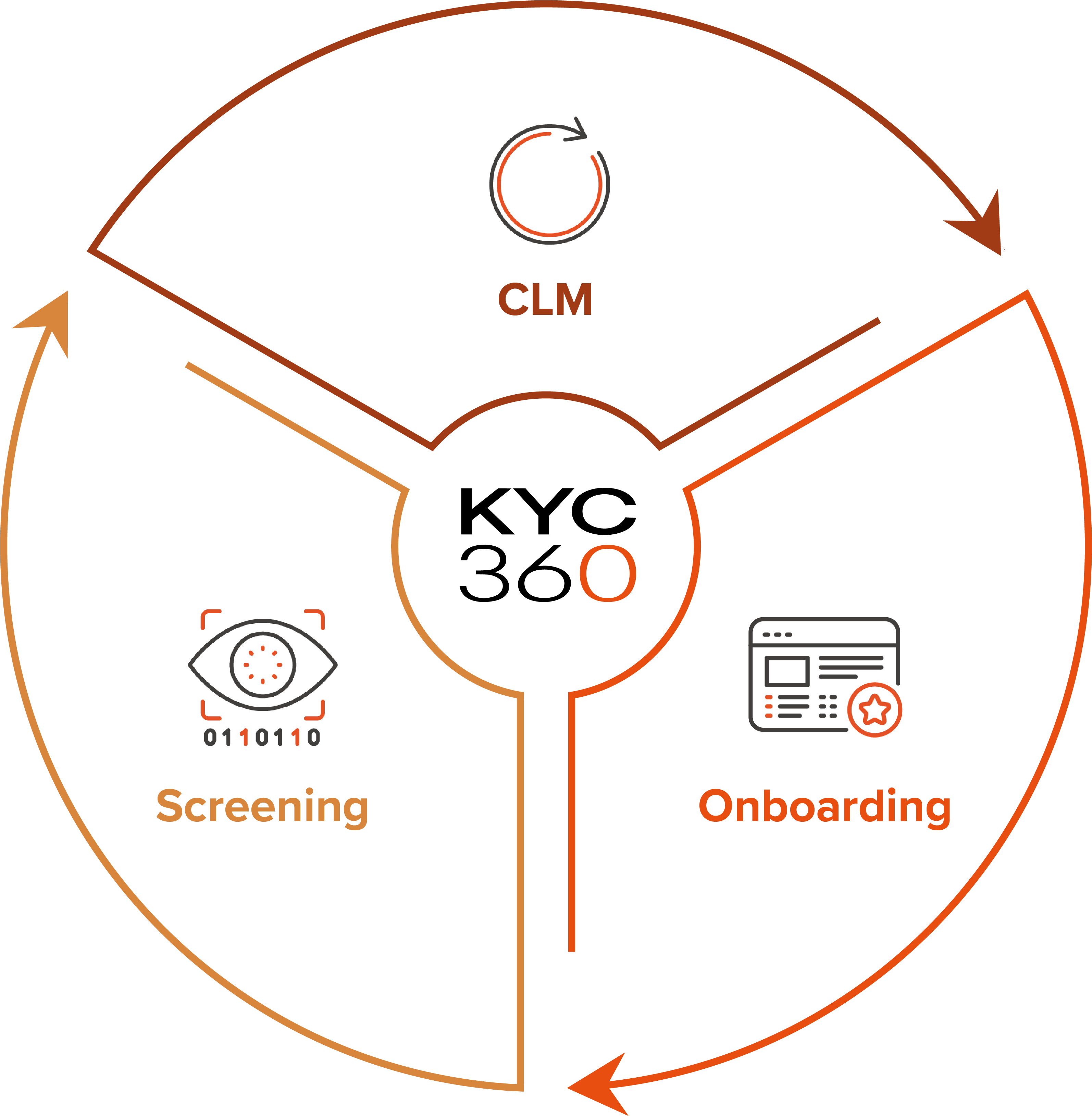

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.