KYC360 is proud to release its latest industry report, "The Future of KYC Remediation: Top Priorities and Challenges in 2025." This survey of 116 compliance professionals confirms that KYC remediation remains a complex, resource-intensive process, with firms struggling to manage outdated customer records and fragmented systems amid growing regulatory scrutiny.

With rising enforcement actions and regulatory expectations tightening, firms are tasked with large-scale remediation projects to ensure that customer records meet stringent regulatory requirements.

Key Findings from Remediation Survey:

- Manual processes dominate remediation efforts, leading to inefficiencies and compliance risks.

- Over 40% of respondents expect remediation costs to rise in 2025.

- One-third of firms are actively planning remediation projects in the next 12 months.

- Data quality issues are a primary driver of remediation projects, with firms struggling to maintain accurate, up-to-date customer records.

- Regulatory mandates and audits are a key trigger for large-scale remediation efforts.

Challenges and Considerations for 2025

Survey respondents overwhelmingly reported that remediation costs are increasing, driven by inefficient manual processes and growing compliance demands. Without automated KYC refreshes, organisations contend with large-scale, resource-intensive remediation projects. The survey also highlights that many firms see effective customer outreach as a major challenge. Manual rekeying of data is also seen as a major roadblock, adding further strain to compliance and risk teams.

Download the report to discover the key compliance challenges facing organisations and the essential checklist for managing successful remediation projects in 2025 and beyond.

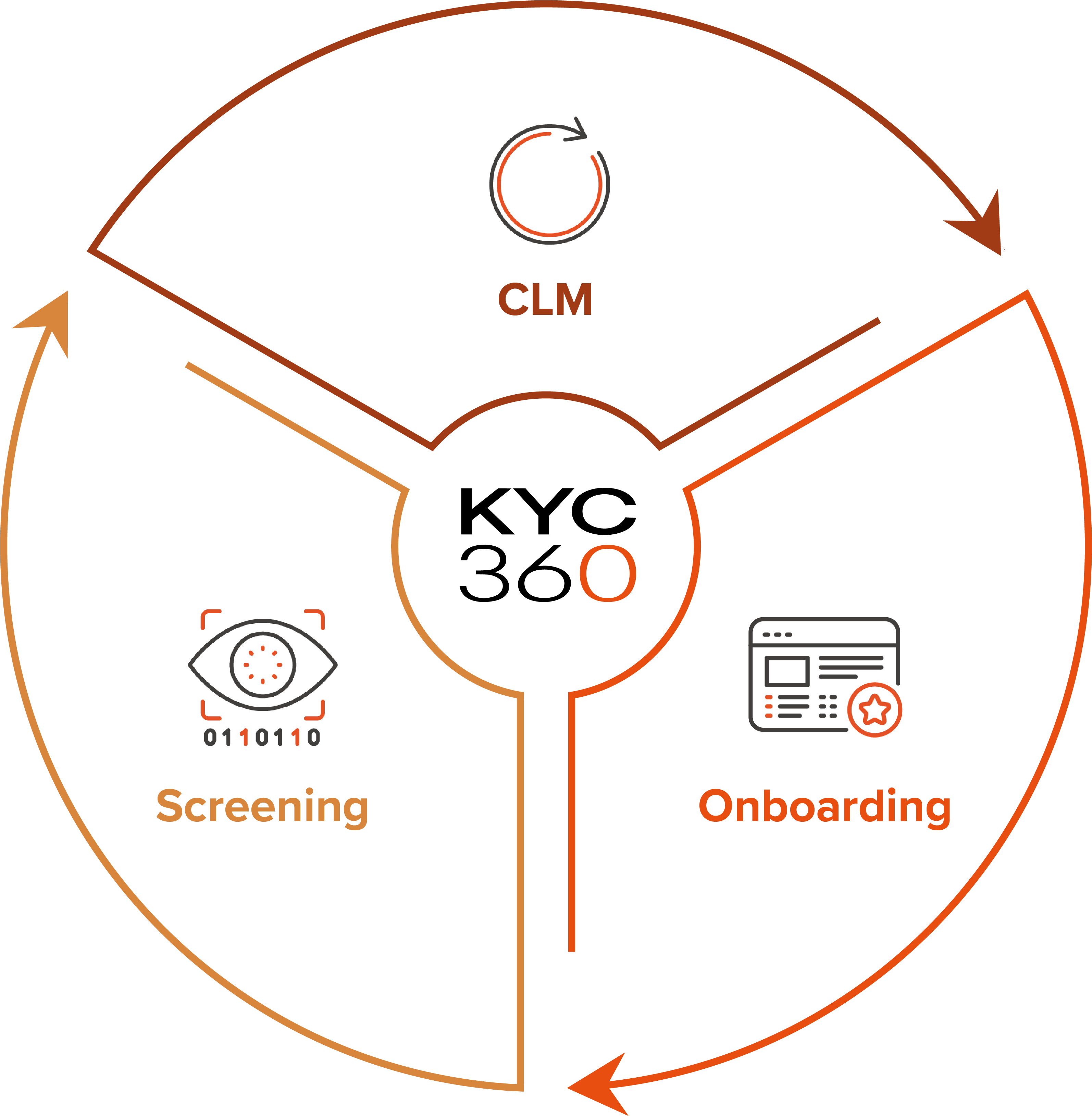

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.