The Australian government has introduced highly anticipated amendments to the Australian AML/CFT regime into federal parliament. They aim to modernise Australia’s approach to fighting financial crime and bring it into line with international standards as mandated by the FATF. The bill aims to strengthen the reputation of Australia as a top financial centre in the wake of high-profile money laundering scandals like the $67 million fine on gambling operator SkyCity

Objectives of New Regulations

This Bill has three key objectives (Source: Austrac).

- “extend the AML/CTF regime to additional services provided by lawyers, accountants, trust and company service providers, real estate professionals, and dealers in precious metals and stones (tranche two entities)

- modernise the regulation of virtual assets and payments technology

- simplify and clarify the regime, to increase flexibility, reduce regulatory impacts and support businesses to prevent and detect financial crime.”

Objective 1: Expansion of AML/CFT Regime to Tranche 2 Entities

The first objective involves bringing “gatekeeper professions” into the new AML regime. This will increase ongoing monitoring and reporting requirements for these firms, making it crucial to identify beneficial ownership of customers. These “tranche two entities” are known to be at a higher risk for money laundering and under the new laws they will be required to register with Austrac.

Objective 2: Modernise Regulation of Virtual Assets

The second objective aims to enhance due diligence of virtual assets and payments technology which are seen as high-risk areas. The term in the AML/CFT act will be changed from “digital currency” to “virtual assets” as this broader definition includes stablecoins, NFTs, governance tokens and utility tokens. Any business involved in the exchange or custody of these assets will be subject to the regime.

Objective 3: Modernisation of AML/CFT Regime

The third objective aims to bring Australia’s AML/CTF regime in line with international frameworks such as the FATF. It will simplify the regime to make it easier for businesses to meet their obligations through clarifications of roles and responsibilities and increased flexibility of the framework. These changes will help to improve Australia’s global standing, ensure robustness against financial crime and ensure their competitiveness as a financial centre.

How to Prepare

- Conduct Risk Assessments

Firms must proactively conduct detailed risk assessments to ensure their compliance processes are sufficiently robust and to identify potential vulnerabilities. The reforms set out a clear risk-based approach to follow for all reporting entities. - Invest in Automated Technologies

The changes in legislation will mean greater reporting requirements for businesses. With increasing workloads likely, firms must streamline manual compliance processes with investment in automated technologies. - Invest in Staff Training

Staff must clearly understand their changing obligations under the new laws and be adequately trained to attain the maximum benefit from new technologies. Regular training sessions and clear reporting processes for suspicious activities can help to build a culture of compliance that allows staff to easily adapt to new regulations.

Closing Thoughts

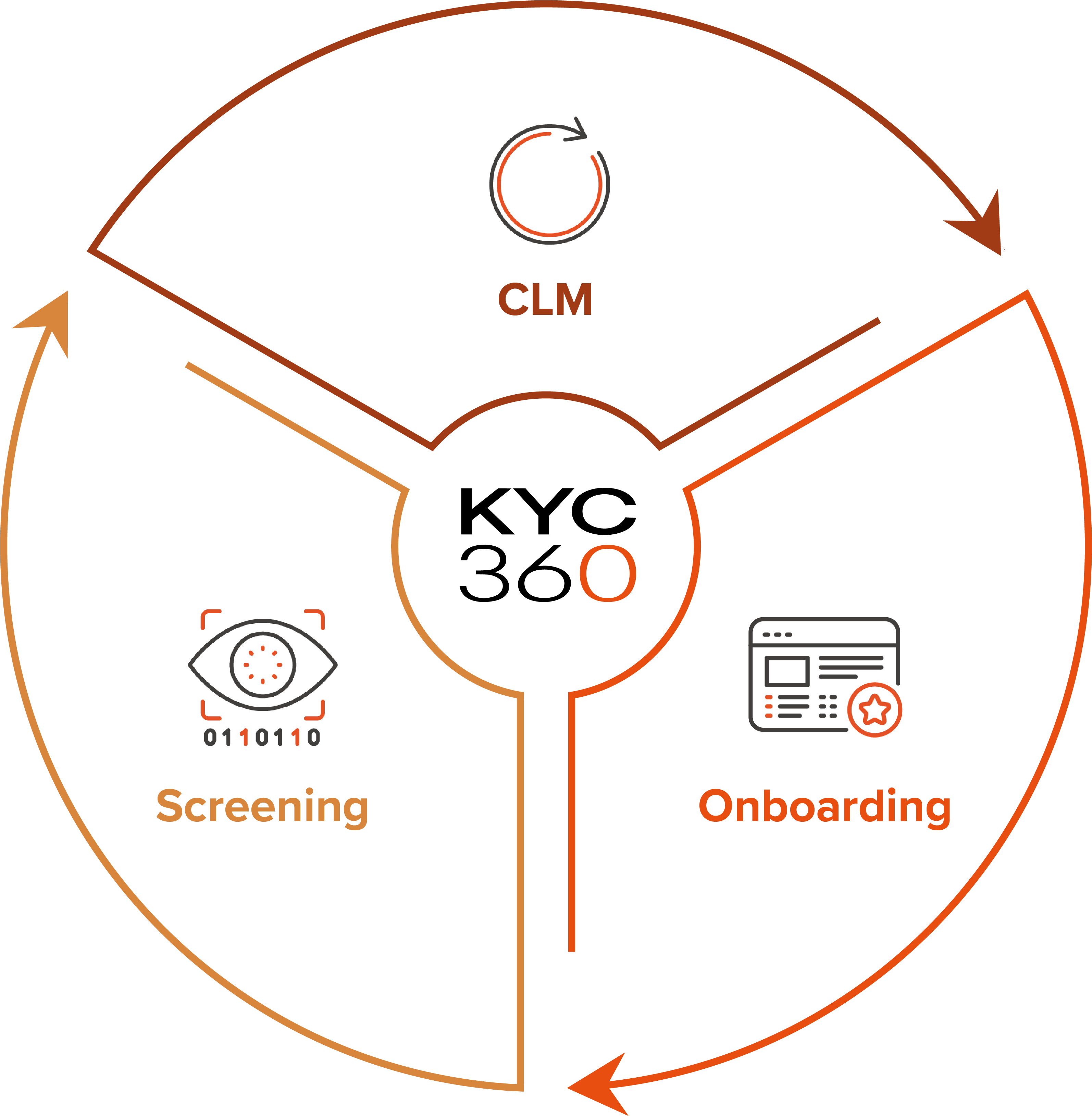

This bill represents a significant overhaul to AML/CFT legislation in Australia. Businesses should start preparing now and implement changes to their processes and systems to ensure they are in the best position when the new regime takes effect. KYC360 allows businesses to fully comply with incoming regulations with our suite of award-winning screening, onboarding and pKYC solutions.

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.