About the Client

ADS Securities (ADSS) is a leading financial services firm based in the UAE, offering institutional and retail trading in CFDs and equities. As a regulated firm, client screening is a critical component of its compliance operations.

About RiskScreen

Our intuitive web-based manual screening solution ‘RiskScreen’ powered by KYC360 technology allows organisations to rapidly conduct manual screening across global sanctions, PEP and watchlist information provided by leading data provider Dow Jones. Organisations can perform as many one-off searches as and when they are needed, with no limit on the number of users. Riskscreen is available as a Salesforce app, allowing organisations to directly screen customers and prospects without friction.

The Challenge

Before implementing the RiskScreen Salesforce App, the ADS team was using a legacy screening system that lacked accuracy, visibility, and seamless integration.

Given the evolving regulatory landscape and increased scrutiny around sanctions compliance, ADS needed a more robust solution to mitigate reputational and enforcement risk.

The Solution: RiskScreen Salesforce App

ADSS deployed the RiskScreen Salesforce App, a native screening tool that integrates directly into the Salesforce CRM. This enabled ADSS to automatically screen prospects and clients without any manual import/export or friction between systems.

Cases are automatically generated for any potential matches, and the onboarding team reviews them in-platform to assess and rule out false positives. ADSS is able to utilise leading data provider Dow Jones through RiskScreen and it has embedded the solution directly into the client approval workflow.

Key Benefits

Key Benefits

- Faster customer onboarding

Clear pass results allow the team to approve clients more quickly, significantly improving onboarding efficiency. - Ongoing riskmanagement

Clients can easily be screened continuously throughout the customer lifecycle. - Regulatory assurance

With increasing expectations from regulators, the KYC360 provides a secure and auditable way to effectively manage sanctions and PEP compliance.

Discover how RiskScreen can transform ad-hoc screening for your organisation and purchase credits instantly.

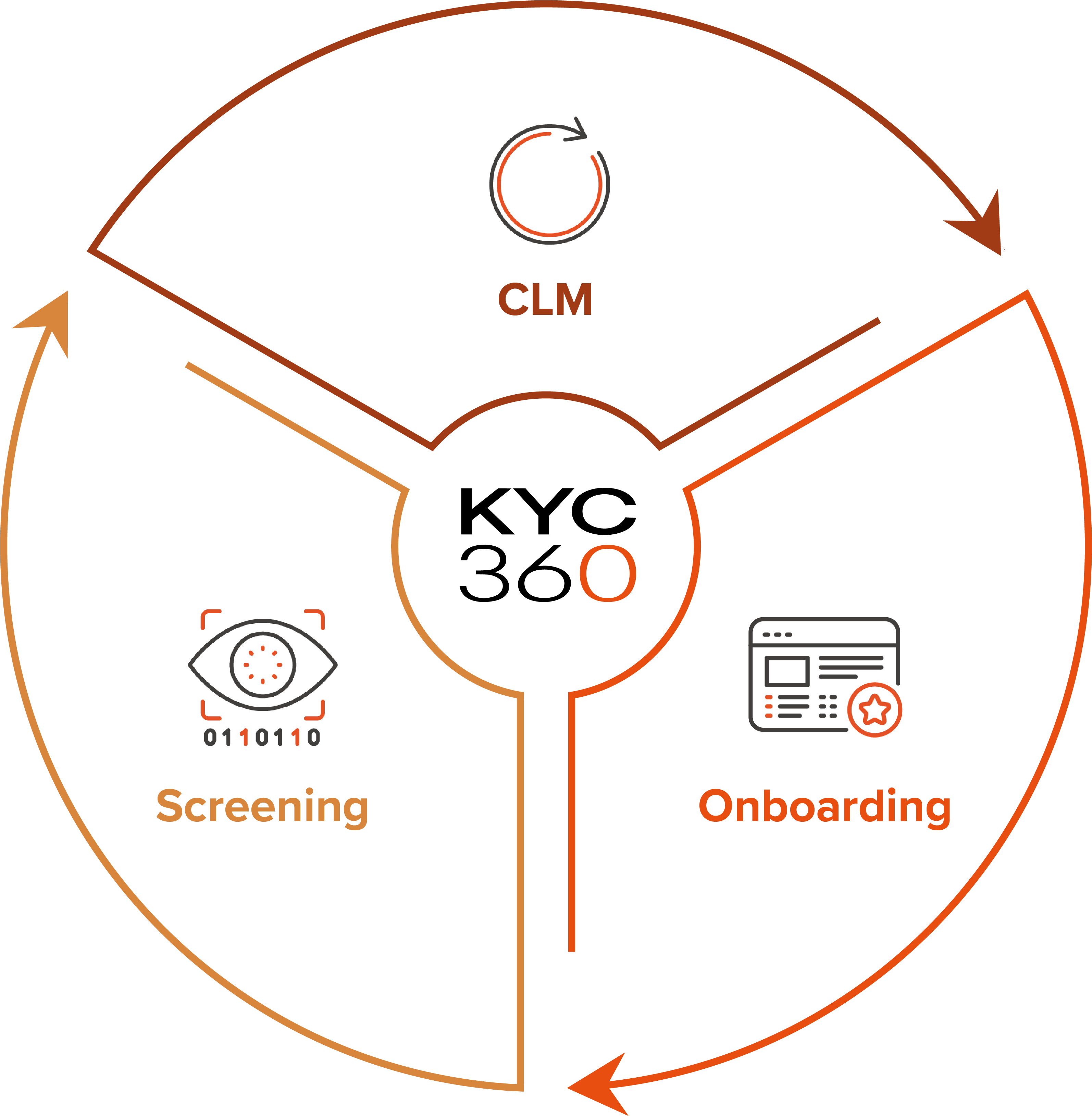

The KYC360 platform is an end-to-end solution offering slicker business processes with a streamlined, automated approach to Know Your Customer (KYC) compliance. This enables our customers to outperform commercially through operational efficiency gains whilst delivering improved customer experience and KYC data quality.