The Challenge

The Challenge

KYC360 were approached by a major banking group operating across multiple jurisdictions. The Bank recognised that its traditional customers in certain segments were seeking more agile banking solutions and so when reviewing this need alongside regulatory requirements, were seeking to digitise the client onboarding experience of their account opening process.

Predominantly manual and paper based, the existing processes involved teams operating across multiple locations (including offshore jurisdictions), to perform checks on documentation, often needing to rework the information provided to establish risk levels, identification and customer suitability.

Challenges in one jurisdiction meant that identification was often presented to the bank in poor condition, making it difficult to use as proof of ID. A lack of permanent land-based addresses for sea-faring customers caused traditional ways of verifying addresses to become impossible. Additionally, the need for non-standard utility bills made verifying customer addresses difficult. Feedback to the customer where further information was required caused frustration, especially if the customer had already provided the information. Time taken to turn the requests around were constrained logistically due to remote locations.

Information was entered into the Bank’s systems manually, for other teams within the Bank to then continue to process into separate systems, for risk reviews and subsequent account approval or rejection.

The existing account opening method did not give the customer a modern experience, with applications taking upwards of three weeks to process. With little or varied management information it was difficult for the Bank’s teams to monitor progress or track individual applications end-to-end.

The Solution: Onboarding

The Solution: Onboarding

The Bank set a vision to digitise the entire customer application process to reduce the time taken from the initial application to final approval of new accounts and ultimately improve the overall customer experience.

They selected KYC360 to implement their Onboarding product to not only reduce time-to-revenue but simplify a fragmented and complex process and bring consistency across the compliance group.

The solution design leveraged existing banking technology to enable integration via API to trigger the automation of the new onboarding process. A ‘right first time’ approach was adopted by the bank’s teams, which meant that the correct information collected from the customer once and upfront to enable better quality information gathering. KYC360’s API was used to import the correct information from the Bank and drive the rest of the process through the Onboarding solution.

The Bank adopted a risk-based approval process ensuring that low risk applications were processed as quickly as possible and applications requiring closer inspection by the Bank’s teams were reviewed more appropriately using up to “eight eyes” approval.

KYC360’s solution allows risk scores to be applied using a weighting method, meaning that answers provided by the customer could be reviewed automatically against the Bank’s risk methodology.

Journeys were designed for each type of customer, ensuring that the data collection process focussed on seeking only the most appropriate information. The journeys included automatic AML screening using the KYC360 Screening product with the LSEG World-Check dataset.

The solution included e-ID&V partner technology to allow automatic customer verification, using liveness tests to facilitate facial identity verification and requiring better quality machine-readable images of ID documents such as driving licences, passports and National ID cards.

KYC360 provided a branded invitation to the end customer, using a secure email and a mobile phone application, to help build end customer trust in the communication from the software.

KYC360 provided a dashboard facility to oversee the applications at each stage of the onboarding process, allowing improved management information to help further improve internal operations. All data collected during the journeys including documents uploaded by the customer were accessible for re-use within the Bank’s key processes.

The Results

The Results

KYC360 were able to work collaboratively with the Bank to deliver the project, including out of the box product training and configuration, National ID issue root cause analysis support, a series of product improvements, and support with regulatory approval.

The Bank saw immediate results with onboarding times cut by a third for new customers.

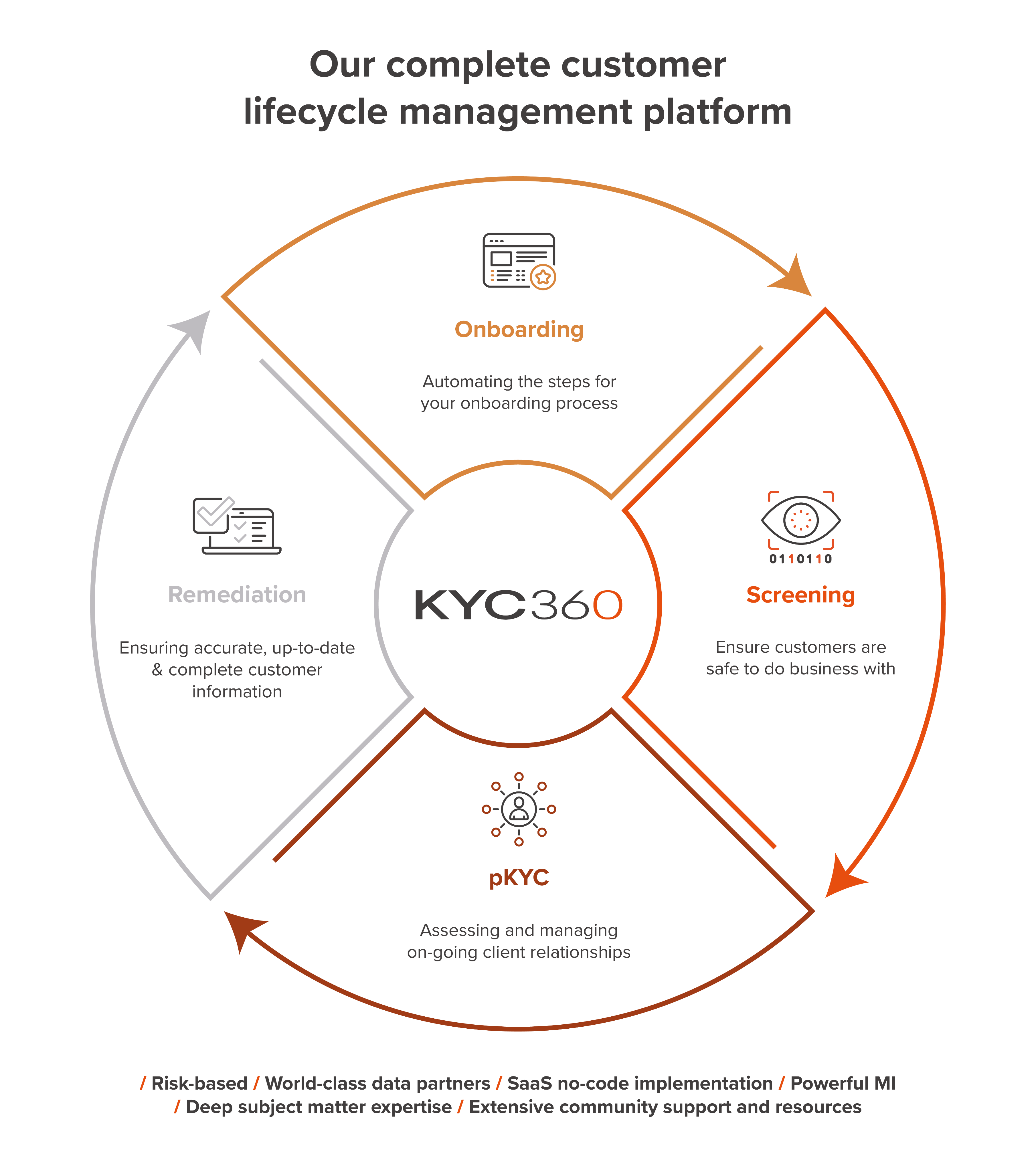

Comply and Outperform with our CLM Platform

|

Reduce time to value, enhance customer experience and drive operational efficiencies with solutions designed by industry experts. Transform your compliance processes into a competitive advantage with KYC360’s award-winning technology. KYC360’s suite of Customer Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards. Consolidate your system stack and data vendor relationships with one platform to cover all Onboarding, pKYC and Screening tasks featuring pre-integrated data sources under a single license agreement. Architected for rapid deployment with guaranteed rapid ROI the KYC360 end-to-end no-code SaaS platform is flexible, fully configurable and modular so that you option and pay only for the functionality you need.

|

|