High Value Goods

AML and KYC vulnerabilities

Where High Value Goods may be vulnerable to AML risk

Criminals love High Value Goods. But their purchases of high-end products such as jewellery, cars, art and even wine aren’t necessarily about flaunting their wealth or enjoying their ill-gotten gains. Rather, the aim is often to facilitate further wrongdoing – the laundering of the proceeds of the original crime.

High Value Goods represent a useful store of value for criminals converting cash, as well as bestowing credibility upon them. In addition, they can be sold as well as bought, so that the proceeds then appear to come from a legitimate source. Alternatively, criminals may return goods bought with the proceeds of wrongdoing in order to obtain a cash refund that appears legitimate.

There are numerous examples of these practices. In Brazil, for example, “Operation Car Wash”, a three-year investigation into corruption involving executives at the state oil company Petrobras, uncovered a criminal network laundering the proceeds of crime through purchases of luxury crimes.

In Los Angeles, the fashion industry was targeted by 1,000 law enforcement officers investigating money laundering linked to drug dealing. In the UK alone, the watchdog Transparency International believes High Value Goods have been used to launder tens of millions of pounds of criminal cash in recent decades.

Opportunities for this type of money laundering continue to multiply. For one thing, the High Value Goods industry itself is booming. In 2020 alone, the global High Value Goods market was worth $1.14 trillion according to research by Bain, a 15% increase on the previous year. In addition, we are also seeing the development of a digital realm for High Value Goods, with brands such as Balenciaga launching outlets in virtual worlds such as gaming platform Fortnite; the explosion of interest in non-fungible tokens (NFTs), including those linked to High Value Goods, is another example.

Not surprisingly, financial regulators are alive to these dangers and have been keen to take action for some time. The Financial Action Task Force on Money Laundering (FATF), the inter-governmental body responsible for setting worldwide AML standards, has repeatedly warned about the use of High Value Goods in money laundering. In the US, the Financial Crimes Enforcement Network (FinCEN) warned earlier this year that it was focusing particularly on the role of High Value Goods in public corruption cases.

In Europe, meanwhile, the regulatory pressure is mounting. High Value Goods have been specifically targeted by money laundering legislation through each iteration of the European Union’s Anti Money Laundering Directives, including further extensions to the relevant provisions in 2020 with the introduction of the Fifth Anti Money Laundering Directive.

And in the UK, “high-value dealers” are included in the list of businesses to which money laundering regulations apply, alongside the likes of financial institutions and estate agents.

The bottom line is that every business in the High Value Goods market now needs to understand how anti-money laundering (AML) regulation potentially impacts their activities, and how to respond accordingly. Those that fail to act risk regulatory sanctions and substantial reputational damage.

KYC and AML are powerful complements to each other and important elements for High Value Goods companies looking to protect themselves against fraud and financial crime. Both involve verifying the identity and legitimacy of individuals and organisations through rigorous checks. In itself, that makes it harder for criminals to operate. In addition, AML checks help to uncover the money trail, understanding where money comes from and how it’s spent so that organisations can ensure it’s not laundered through them.

Opportunities for this type of money laundering continue to multiply. For one thing, the High Value Goods industry itself is booming. In 2020 alone, the global High Value Goods market was worth $1.14 trillion according to research by Bain, a 15% increase on the previous year. In addition, we are also seeing the development of a digital realm for High Value Goods, with brands such as Balenciaga launching outlets in virtual worlds such as gaming platform Fortnite; the explosion of interest in non-fungible tokens (NFTs), including those linked to High Value Goods, is another example.

Not surprisingly, financial regulators are alive to these dangers and have been keen to take action for some time. The Financial Action Task Force on Money Laundering (FATF), the inter-governmental body responsible for setting worldwide AML standards, has repeatedly warned about the use of High Value Goods in money laundering. In the US, the Financial Crimes Enforcement Network (FinCEN) warned earlier this year that it was focusing particularly on the role of High Value Goods in public corruption cases.

In Europe, meanwhile, the regulatory pressure is mounting. High Value Goods have been specifically targeted by money laundering legislation through each iteration of the European Union’s Anti Money Laundering Directives, including further extensions to the relevant provisions in 2020 with the introduction of the Fifth Anti Money Laundering Directive.

And in the UK, “high-value dealers” are included in the list of businesses to which money laundering regulations apply, alongside the likes of financial institutions and estate agents.

The bottom line is that every business in the High Value Goods market now needs to understand how anti-money laundering (AML) regulation potentially impacts their activities, and how to respond accordingly. Those that fail to act risk regulatory sanctions and substantial reputational damage.

KYC and AML are powerful complements to each other and important elements for High Value Goods companies looking to protect themselves against fraud and financial crime. Both involve verifying the identity and legitimacy of individuals and organisations through rigorous checks. In itself, that makes it harder for criminals to operate. In addition, AML checks help to uncover the money trail, understanding where money comes from and how it’s spent so that organisations can ensure it’s not laundered through them.

In other areas, such as high-end real estate and yachting, the use of anonymous shell companies and intermediaries is an entrenched feature of the marketplace; such practices do not necessarily mean money laundering is taking place, but they certainly make it harder to detect. Another factor is the culture of discretion and confidentiality that is a common feature within most of the High Value Goods market. The desire to respect the privacy and security of high-net-worth customers may be entirely reasonable, and even desirable, but it does give rise to additional money laundering vulnerabilities.

The breadth of the market is another issue, making it difficult for regulators to monitor suspicious activity. The UK’s AML guidance from HM Revenue & Customs, for example, lists no fewer than 17 sub-sectors of the industry, from alcohol to electronics, and from boats and yachts to textiles and clothing. Some of these sub-sectors may be more problematic than others. Areas identified by campaigners and watchdogs as particularly exposed to money laundering include:

|

Art Groups such as the Basel Institute on Governance have repeatedly warned of the art market’s attractions to money launderers. The size of the global market – worth $65bn last year alone – makes it an attractive place to hide illicit transactions. Individual works may be both very high in value and small enough to easily transport. The use of intermediaries, offshore accounts and shell companies in transactions is extensive. There has also been concerns about the use of the art market in funding terrorism – amid breaches of countering the financing of terrorism (CFT) regulation – with accusations that groups such as Isis have sold antiquities to raise cash. |

Precious stones and jewels Precious metals offer a “high value to mass ratio” – a million dollars’ worth of diamonds, say, is relatively easy to carry across borders illegally. They are also commonly used in trade-based money laundering. For many years, however, regulators have struggled to crack down on this part of the High Value Goods sector. One FATF report, for example, pointed out that while Antwerp hosted up to 80% of the world’s diamond trading, its merchants had made almost no suspicious activity reports. |

|

|

|

Personal luxury items These include goods such as fashion-ware, watches, jewellery and accessories. Easily transportable, they offer a quick and simple way to make purchases using criminal cash. For example, designer clothes featured prominently in reports about the case of money launderer Ramon Olorunwa Abbas, popularly known by his Instagram handle “hushpuppi”. |

Luxury cars High-end automobiles have been described as the perfect vehicle for money launderers. One case in particular sparked a worldwide alert. The sale of 25 supercars in Switzerland in 2019, including Ferraris, Maseratis and Lamborghinis, followed an inquiry into the affairs of Teodoro Nguema Obiang, a prominent politician in Equatorial Guinea accused of syphoning off cash from the country’s oil sector. |

The regulatory environment

In the UK, luxury brands and other sellers of high-value goods were specifically singled out in the Money Laundering Regulations of 2017 (MLR).

Under this regulation, any business accepting or making cash payments of €10,000 or more in exchange for goods, must:

- Implement relevant anti-money laundering policies, controls and procedures.

- Undertake risk assessments.

- Carry out customer due diligence.

- Report any suspicious activity.

The European Union’s Fifth Anti Money Laundering Directive, which came into force in the UK from 2020, built on these foundations to add further regulation

This includes requirements that:

- Art intermediaries, such as dealers, gallery owners and auctioneers, comply with money laundering regulations if a transaction or linked transactions amount to €10,000 or more.

- Art intermediaries caught by the threshold must register annually with HM Revenue& Customs.

- Customers paying for goods with pre-paid cards such as travel and gift cards issued outside of the EU must be subjected to identity checks for transactions over €150 made directly in a shop or €50 or above made online.

The 2020 update also extended the €10,000 threshold, which previously only applied to cash payments, to payments of any method including cheques, credit or debit card charges and bank transfers. It also introduced enhanced due diligence measures that are required for transactions involving high-risk countries. Luxury brands may also be restricted from opening branches and subsidiaries in these countries.

HMRC continues to update the guidance on how this regulation applies to luxury brands operating in the UK, publishing its latest version in 2020.

![]()

The international perspective

Anxiety about the vulnerability of the High Value Goods sector to money laundering is a global phenomenon. Most developed-market jurisdictions have taken at least some steps towards targeted regulation of the sector.

In the European Union, the relevant regulation is set out in the 5th Money Laundering Directive, though this is due to be superseded by the 6th Anti-Money Laundering Directive in 2024. The regime outlines minimum standards for appropriate AML activity, with requirements in areas including know your customer, know your business and ultimate beneficial ownership. In the US, the Biden Administration is taking a tough line on money laundering regulation, which may see the introduction of new requirements. In January, for example, the US Treasury published a comprehensive study on the facilitation of money laundering in the art sector, and warned that new regulation might be necessary. FinCEN, meanwhile, continues to monitor the broader High Value Goods market very closely.

![]()

Complying with sanctions

All organisations are required to comply with sanctions and export controls that may be imposed by the UK Government or other jurisdictions on specific individuals or corporate entities. The number of these sanctions currently in force has increased significantly in recent months as the international community has targeted Russia and Russian entities following its illegal invasion of Ukraine.

The Government confirmed the list of products which face an export ban to Russia. The list covers products priced over £250 including handbags; garments, clothing, accessories and shoes; carpets, rugs and tapestries; pearls, semi-precious stones and jewellery; and sports equipment and clothing.

How to comply with AML and KYC regulation

Failing to comply with money laundering regulation brings the risk of criminal prosecution. In the UK, penalties for breaches of the regulation include unlimited fines and up to two years in prison. Civil prosecutions are also possible.

There is also the potential for substantial reputational damage. For this reason, having policies and procedures in place to ensure compliance with AML and KYC regulation is vital.

Every high-value dealer’s senior managers – officers or employees with the authority to make decisions that affect the business’s exposure to money laundering and terrorist financing risk – must take AML seriously.

Legal responsibilities include a duty to identify, assess and effectively manage money laundering risk, to take a risk-based approach to managing risk, and to appoint a nominated officer to report suspicious activity to the National Crime Agency.

|

Customer due diligence High-value dealers must carry out due diligence on all customers and beneficial owners before entering into a business relationship with them, or carrying out a one-off transaction of more than €10,000 on their behalf. The requirement is to “know your customer” – to make identity checks to verify that the customer is who they say they are. In practice, High Value Goods companies are entitled to take a risk-based approach; more basic checks will be acceptable for customers assessed as low-risk, but there must be a policy in place to make that assessment in the first place. Equally, it is important to recognise that customer due diligence duties do not end after the first checks are completed; ongoing business relationships must be monitored on a continuing basis. |

|

Enhanced customer due diligence Customers who are assessed as higher risk must be subjected to enhanced due diligence requirements. Examples include situations where the customer is from a high-risk country identified by the UK Treasury, the EU or the FATF; where the transaction is complex, unusually large or with an unusual pattern and has no apparent legal or economic purpose; where the customer or transaction is identified as posing a high risk of money laundering or terrorist financing. In these cases, High Value Goods companies will be required to do more to verify the identity of the customer, and to scrutinise the background and nature of the transactions. That might include asking for additional evidence of identity, including corroboration from independent sources, seeking expert validation of identity, and making extra financial checks on payments and source of wealth. |

|

PEP screening Politically exposed persons (PEPs) are individuals (and their close associates, including family members) who may be more susceptible to being involved in bribery or corruption because they hold a prominent position or influence. Where a customer is identified as a PEP, the high-value dealer will be automatically required to make enhanced AML checks. In such cases, a senior manager at the company must give their approval before a business relationship is established with the customer. High Value Goods companies will also need to be able to show they have taken adequate steps to establish the source of wealth and source of funds that are involved in the proposed business relationship or transaction. In addition, there is a requirement to conduct enhanced ongoing monitoring of continuing business relationships. In the UK, the Financial Conduct Authority publishes guidance on how to identify and treat PEPs, their family members and their associates. |

|

Beneficial owners are individuals who ultimately own or control the customer, or on whose behalf a transaction or activity takes place. For example, High Value Goods companies may often find they are selling a product to a representative of the actual customer, rather than dealing with the customer in-person. Identifying the involvement of a beneficial owner in a transaction is part of normal customer due diligence checks. In such cases, High Value Goods companies must take reasonable steps to identify the beneficial owner’s identity. |

|

Sanctions screening New customers may be subject to specific sanctions and export controls themselves, or have links to individuals and countries that have been targeted. Existing customers may become subject to sanctions over time. High Value Goods companies therefore need to make checks related to this issue, bearing in mind that sanctions may be in force from both individual countries, such as the UK, and supra-national bodies such as the EU. In the UK, the Office of Financial Sanctions Implementation offers extensive advice on sanctions and related issues. The EU publishes similar advice. There are also specific rules on products worth more than £250 which may not be sold to Russia. |

|

Suspicious activity reports The Proceeds of Crime Act requires the reporting of suspicious activity to the National Crime Agency; high-value dealers are covered by this duty. This will require High Value Goods companies to maintain systems capable of identifying red flag transactions or activity that gives rise to suspicion. Inevitably, the definition of suspicion is subjective. However, the broad guidance is that businesses should be concerned if they have any suspicion that the funds or goods involved in the transaction are the proceeds of crime. There is no requirement to know what sort of crime has been committed, but one or more warning signs of money laundering which can’t be explained by the customer will be relevant. Inevitably, the definition of suspicion is subjective. However, the broad guidance is that businesses should be concerned if they have any suspicion that the funds or goods involved in the transaction are the proceeds of crime. There is no requirement to know what sort of crime has been committed, but one or more warning signs of money laundering which can’t be explained by the customer will be relevant. |

What to do next

The role of technology

Manual solutions to AML/CFT and KYC compliance are increasingly impractical. The workload is simply too large, exposing gaming and gambling operators to regulatory sanction and reputational damage in the event that staff make mistakes or overlook problem cases.

For this reason, technologies that harness tools such as automation and machine learning are increasingly important to AML compliance.

Automating AML and KYC processes provides comfort that activities such as screening and monitoring are taking place quickly and accurately, reducing the risk of a compliance failure. There is also an opportunity to leverage external data sources in order to strengthen compliance even further.

Another advantage of using such tools is that they automatically create an audit trail, providing gaming and gambling operators with a means through which to account for their actions to regulators and other stakeholders. Together, AML and KYC are necessary requirements to effectively manage the end-to-end customer lifecycle.

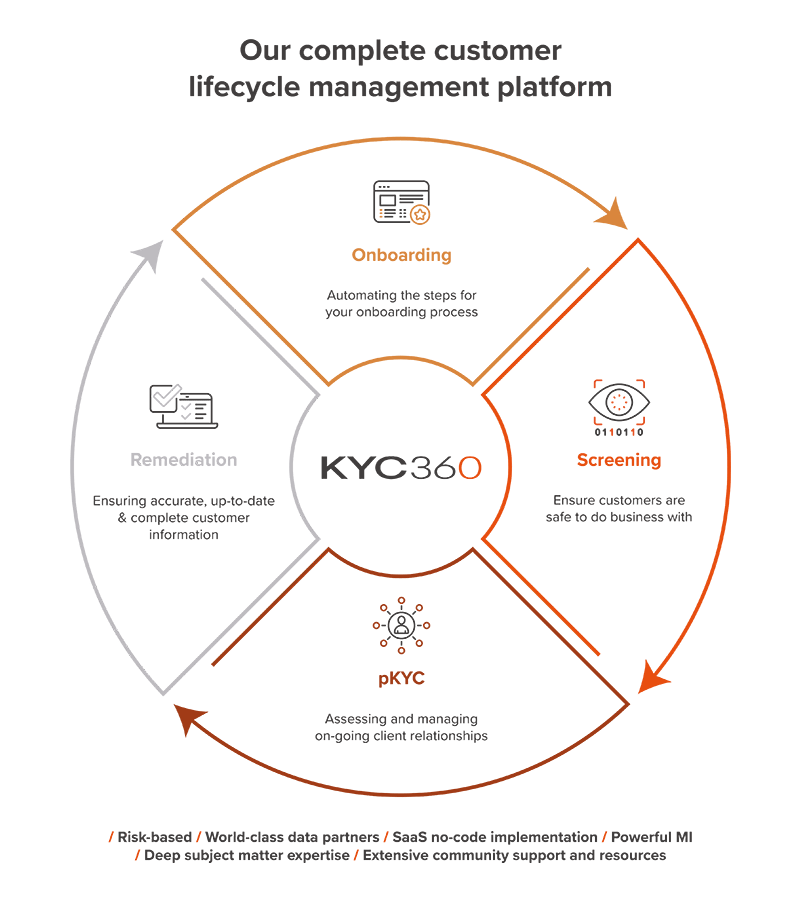

Comply and Outperform with KYC360

Until now, compliance has been a barrier to business - it’s made doing business slower and more difficult by creating friction through clunky processes, siloed data and human error. The opportunity now exists for organisations to outperform commercially through the way they comply. Compliance has evolved from being a barrier to becoming a major point of difference in how businesses accelerate time to revenue, increase profitability and improve customer experience.

Our Customer Lifecycle Management SaaS Platform takes care of all aspects, from creating the right first impression with rapid risk-based onboarding, through to award-winning screening and KYC refresh that enable your business to:

-

Realise massive operational efficiencies

-

Achieve rapid ROI through the speedy deployment of our no-code solutions and

-

Master complexity with solutions that evolve as regulations change

All at the same time as delivering even higher levels of compliance assurance.