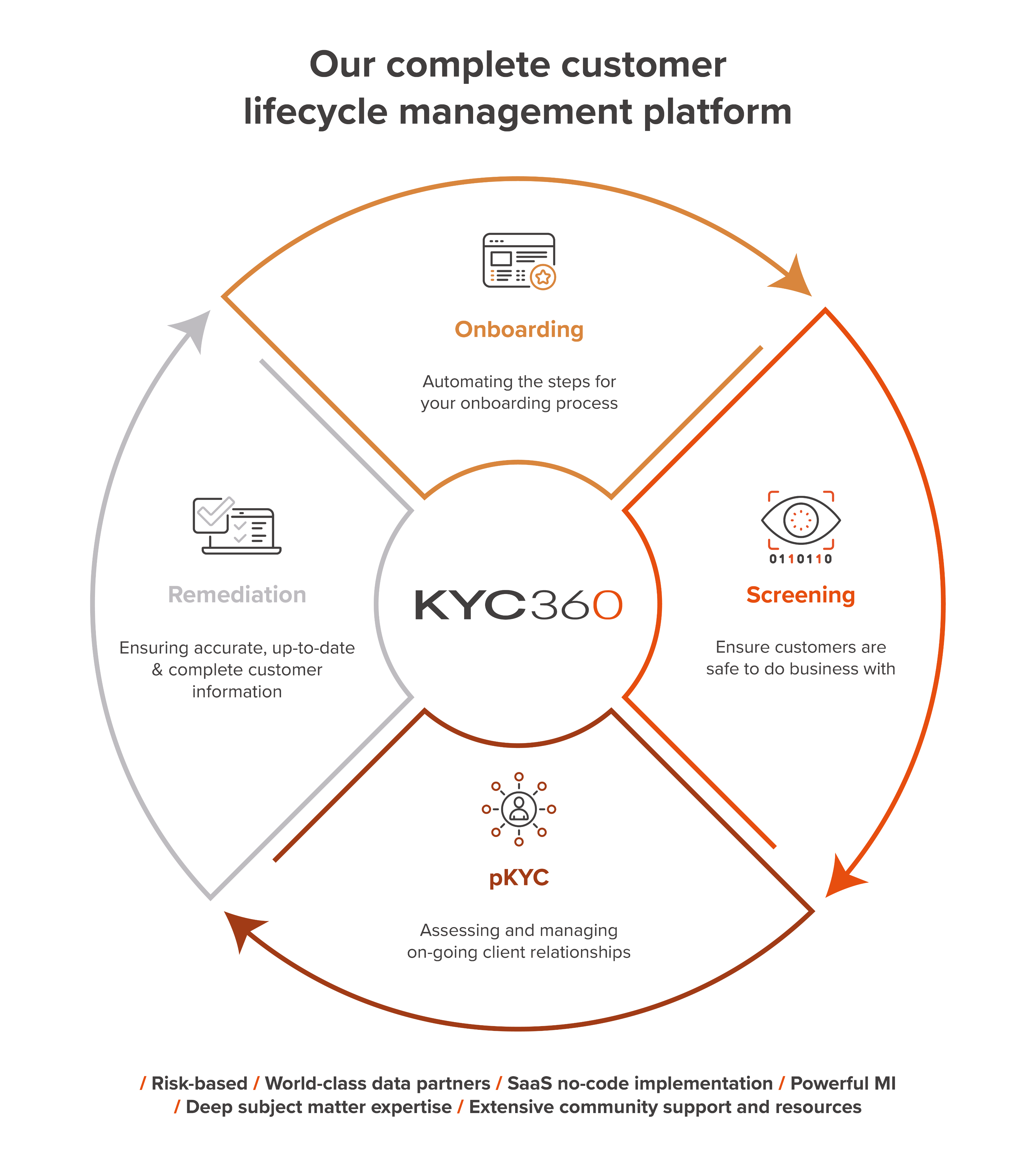

Remediation

Remediating KYC data for existing customers is a near-constant task for many financial institutions either because they have identified for themselves that some of their customer KYC information is out of date, or because they have been compelled to undertake remediation by an auditor or regulatory body. Remediation typically involves updating or sourcing KYC information held on client files and analysing whether the customer’s risk categorisation is accurate.

In the case of some historic customer relationships KYC remediation can amount to almost a new onboarding of the customer, as nearly all the information held has to be renewed. In other cases it may only be a few details that need to be confirmed or updated. Whatever the position KYC remediation is an onerous and time-consuming task for the following reasons:

- Identifying the customer relationships requiring remediation is a major challenge for businesses that do not have automated in-life monitoring technology.

- In most businesses remediation is a manual exercise, done piecemeal by email and letters. It is a drag on staff productivity and morale.

- The customer’s motivation to supply fresh KYC information is lower than when they’re being onboarded requiring more chasing and correspondence. Some customers are very irritated by the process.

- Few businesses have dedicated remediation teams. If compelled by a regulator, they may hire a consultancy firm to outsource the exercise. They hate this because it is colossally expensive and usually of only limited effectiveness.

- If they have not outsourced it, it becomes an extra task for staff who are already busy on other duties. It is rarely high priority and is therefore almost always behind schedule.

KYC360 allows businesses to automate customer remediation with an integrated full-service solution that provides you with peace of mind that KYC information for your entire customer base can be remediated. If connected with KYC360’s CLM module the remediation capabilities of KYC360 will permit perpetual KYC even for complex customer relationships delivering massive operational efficiencies and a happy KYC refresh process for your customers that will distinguish you from your competitors.

Benefits & Features

KYC360’s suite of Client Lifecycle Management software solutions is designed to transform your business processes enabling you to outperform commercially through operational efficiency gains and superior CX whilst remaining fully compliant with evolving regulatory standards.